This article contains affiliate links. If you click on a link in this article, I may earn a small commission at no extra cost to you.

If you’re just finding the experiment now, welcome. You have some catching up to do. Let me explain. No, there is too much. Let me sum up.

On the 1st of January, 2018, I bought $100 each of the Top Ten cryptos at the time for a total investment of $1000 to see how they would perform over the year. I tracked the experiment and reported each month. I then extended the 2018 experiment repeated the process with the new 2019 Top Ten group of cryptos. How is it going?

After two years the 2018 Top Ten were down -86%.

After one year the 2019 Top Ten broke just about even (up +2%).

I decided to keep things going in 2020, so I repeated the experiment yet again. The round three coins are:

Bitcoin, Ethereum, XRP, Tether, Bitcoin Cash, Litecoin, EOS, Binance Coin, Bitcoin SV, and Tezos are the coins I’ll be tracking as part of the 2020 Top Ten Crypto Index Fund Experiment.

Let’s get into it. Here’s the 2020 Top Ten Crypto Experiment update for January.

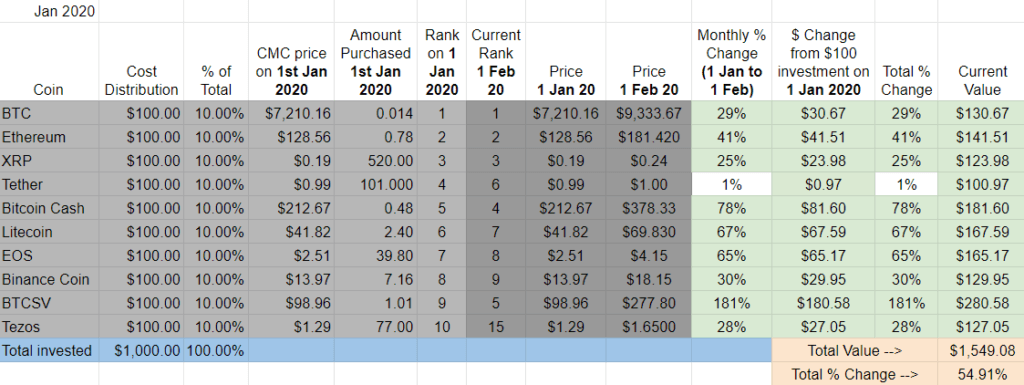

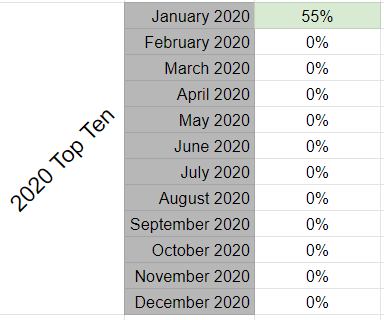

Month One – UP 55%

Well there’s something you don’t see everyday. Or at least I don’t after twenty five months of running these experiments: an all green month. Great start for the 2020 batch and by far the strongest January since the Top Ten experiments started in 2018.

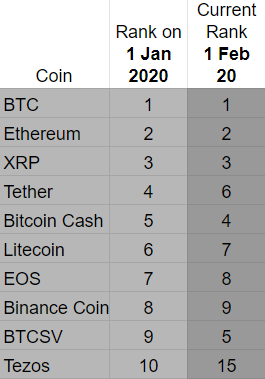

Ranking and January Winners and Losers

Except for the top three (BTC, ETH, and XRP), there was a ton of movement in January, most of it downward. Tezos crashed hard, down from #10 to #15 and becomes the first to drop out of the Top Ten. Tether dropped two places, always a good sign for the rest of the group. BSV gained the most ground advancing four spots in the rankings.

January Winners – BSV dominated the field finishing January up +181%. Bitcoin Cash finished a distant second place gaining +78%.

January Losers – Tether, which is always great news for the rest of the pack. XRP finished in second place “only” up +25%.

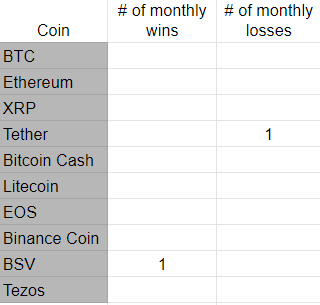

For those keeping score, I keep a tally of which coins have the most monthly wins and losses:

Overall update – BSV takes strong early lead. Tether is the worst performer.

It was hard for the rest of the cryptos to keep up with BSV this month, up +181% in January. That’s more than double what second place Bitcoin Cash gained this month. BSV is already worth $280.

Tether started 2020 in the basement as the rest of the field gained at least +25%.

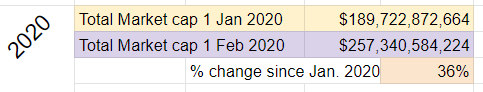

Total Market Cap for the entire cryptocurrency sector:

The crypto market gained over $67B in January 2020, up +36% since New Year’s Day.

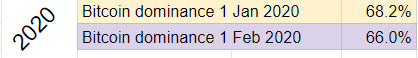

Bitcoin dominance:

Bitcoin dominance dipped a few percentage points to 66% during the first month of 2020, a sign of increasing interest in altcoins.

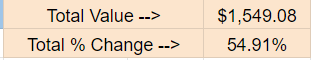

Overall return on investment since January 1st, 2020:

The 2020 Top Ten Portfolio gained about $549 in January 2020. After an initial $1000 investment, the 2020 Top Ten Portfolio is worth $1,549. That’s up about +55%.

There’s not much here at the moment, but we’ll be looking at the entire experiment, month by month in an attempt to keep some perspective:

How does the 2020 Top Ten Experiment compare to the parallel projects?

- 2018 Top Ten Experiment: down about -80% ($202)

- 2019 Top Ten Experiment: up about +63% ($1,631)

Taken together, here’s the bottom bottom bottom line:

After a $3000 investment in the 2018, 2019, and 2020 Top Ten Cryptocurrencies, my portfolios are worth $3,382.

That’s up about 12.7%.

Implications/Observations:

The crypto market as a whole is up about +36% in January compared to the 2020 Top Ten cryptos which have gained +55%. Sticking with the Top Ten coins beat the overall market in January.

Although there are a few examples of this strategy working with the 2019 Top Ten, it’s interesting to note that this hasn’t yet happened with the 2018 group as at no point in the first twenty-five months of the Top Ten 2018 Experiment has the approach of focusing on only the Top Ten cryptos outperformed the overall market.

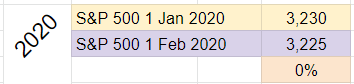

I’m also tracking the S&P 500 as part of my experiment to have a comparison point with other popular investments options. The S&P 500 was flat in January.

The initial $1k investment I put into crypto would now be worth $1000 had it been redirected to the S&P 500.

But what if I took the same world’s-slowest-dollar-cost-averaging/$1,000-per-year-in-January approach with the S&P 500? It would yield the following:

- $1000 investment in S&P 500 on January 1st, 2018: +$210

- $1000 investment in S&P 500 on January 1st, 2019: +$290

- $1000 investment in S&P 500 on January 1st, 2020: +$0

Taken together, here’s the bottom bottom bottom line:

After three $1,000 investments into an S&P 500 index fund in January 2018, 2019, and 2020, my portfolio would be worth $3,500.

That’s up about +17% (compared to +12.7% with the Top Ten Crypto Experiments).

Conclusion:

A nice start to the year for the 2020 Top Ten and the best January since I started updates in 2018. It’s also a nice to be modestly up on the combined 2018, 2019, and 2020 portfolios for a change.

Thanks for reading and for supporting the experiment. I hope you’ve found it helpful. I continue to be committed to seeing this process through and reporting along the way. Feel free to reach out with any questions and stay tuned for progress reports. Keep an eye out for the original 2018 Top Ten Crypto Index Fund Experiment and the 2019 Top Ten Experiment follow up experiment.

This article contains affiliate links. If you click on a link in this article, I may earn a small commission at no extra cost to you.

Help keep the lights on at the Top Ten Crypto Index Fund Experiments.

Donate directly:

Bitcoin: bc1qqy4tlwydyrm3sjpyyq88es0cu9j9mdvqer3gwv

Ethereum: 0xC04Bc1996320f27c0A6018cB370c9469a9Dd3a4C

ADA: addr1qywnu55t8hpk4c3jf63tj5xywzej0uhwh7yput4u2z3fq7qa8efgk0wrdt3ryn4zh9gvgu9nylewa0ugrchtc59zjpuqlj6stg

XLM: GA5GJ2JDWC3GB3YXEVRBSR7UBLIB2ROIWZ5FEHML5WXGY5N3PAIDEOEA

Pingback: $1k invested into the Top 10 Cryptos on January 1st, 2020 Up +716% (MARCH Update – Month 27) – DarkFiberMines.com

Pingback: $1k invested into the Top 10 Cryptos on January 1st, 2020 Up +716% (MARCH Update - Month 27) - WORK 4 BTC

Pingback: $1k invested into the Top 10 Cryptos on January 1st, 2020 Up +716% (MARCH Update - Month 27) - NFT-BOX

Pingback: r/CryptoCurrency – $1k invested into the Top 10 Cryptos on January 1st, 2020 Up +716% (MARCH Update – Month 27) – Economics Stocks

Pingback: Tracking 2020 Top Ten Cryptocurrencies – Month Sixteen -

Pingback: I bought $1000 worth of the Top Ten Cryptos on January 1st, 20120 (Jan 2020 Update) – Nakamoto News

Pingback: I bought $1000 worth of the Top Ten Cryptos on January 1st, 20120 (Jan 2020 Update) : CryptoCurrency – Watch Tech Market

Pingback: I bought $1000 worth of the Top Ten Cryptos on January 1st, 20120 (Jan 2020 Update) | News