Month Nine – Up 20%

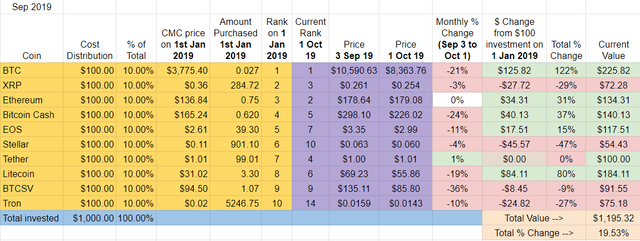

September was another down month for the 2019 Top Ten. While not as bloody as August, all cryptos ended the month in the red except Tether and Ethereum, both of which ended September basically flat. Again, when Tether finishes ahead of the pack, you know it’s been a bad month. This is now two months in a row that Tether has outperformed its Top Ten peers.

We have now observed three straight downward months after a nice five month streak of either gains or sideways movement earlier in the year. The 2019 Top Ten portfolio is up +19.5% on the year, which sounds respectable enough, but here’s some perspective: the end of May saw this same portfolio up +114%.

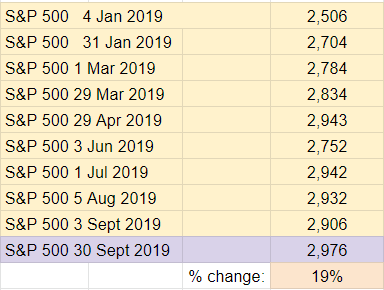

The 2019 Top Ten portfolio is now up about the same as the US stock market as measured by the S&P 500 (see below). We haven’t seen such similar performance since March 2019.

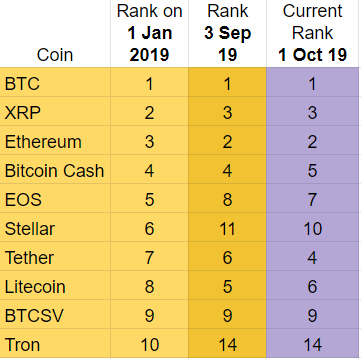

Ranking

Half the cryptos were on the move this month. Litecoin and Bitcoin Cash both dropped one position while EOS, Stellar, and Tether advanced. Tether actually moved up two places and now holds the #4 position. But again, when Tether gains/advances in rank, it’s a sign of a bad month.

Stellar clawed itself back into the Top Ten (again) so now Tron stands alone as a Top Ten dropout, replaced by Binance Coin. Tron is still way down at position #14.

Only having one of the original cryptos bumped out of the Top Ten is actually much better than the 2018 Top Ten Experiment group, who already saw three coins drop out by September 2018.

September Winners – For the second month in a row, I have to give it Tether. Ethereum finished second by not losing any value.

September Losers – Although it managed to retain its position at #9, Bitcoin SV lost -36% of its value in September making it easily the worst performing crypto in the experiment. The second place goes to Bitcoin Cash, down -24.

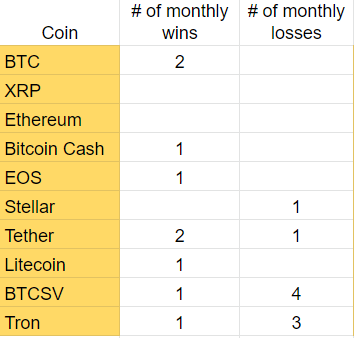

For those keeping score, here is tally of which coins have the most monthly wins and loses during the first nine months of this experiment: Bitcoin and Tether are now tied with two monthly victories each. Bitcoin SV has the most monthly loses and has finished last in four out of the first nine months of 2019.

Overall update – Bitcoin and Litecoin lead the pack, majority of cryptos still in positive territory.

BTC and Litecoin are convincingly ahead of their peers, up +122% and +80% respectively this year. My initial $100 investment in Bitcoin is now worth $226.

The majority of the Top Ten cryptos are still either flat or in positive territory. The exceptions are Ripple, Stellar, Bitcoin SV, and Tron. Stellar remains squarely at the bottom, down -47% so far in 2019, followed by Ripple, down -29%.

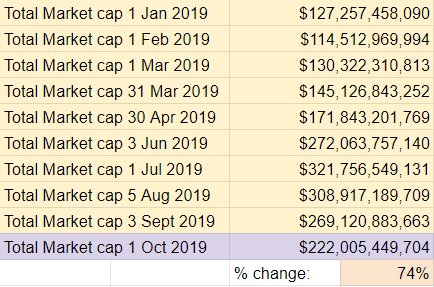

Total Market Cap for the entire cryptocurrency sector:

For the third straight month, the total crypto market cap decreased, losing about $47B in September. The overall market cap is sitting around the $222B mark, a level we last saw in May 2019.

It’s not all bad news: there has been an increase of +74% in total crypto market cap since the beginning of 2019.

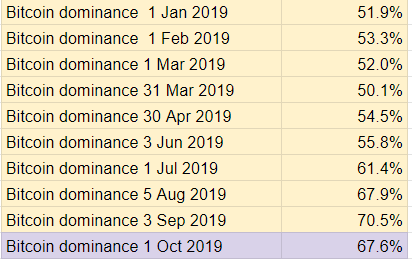

Bitcoin dominance:

September finally saw a decline in Bitcoin dominance, good news for the altcoin space. The 67.6% Bitcoin dominance figure is back near August 2019 levels.

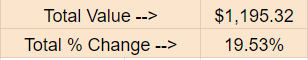

Overall return on investment from January 1st, 2019:

I’m down about -$225 in September (after losing $300 in August and $400 in July). If I cashed out today, my $1,000 initial investment would return $1,195, a +20% gain. This is now about equal to what the stock market has returned (see below).

I’m down significantly in my 2018 Top Ten Index Fund Experiment. If I cashed that group out today, the $1000 initial investment would return about $175, down nearly -83%.

So, taken together, here’s the bottom bottom line: after a $2000 investment in both the 2018 and the 2019 Top Ten Cryptocurrencies, my portfolios would be worth $1,370.

That’s down about -32%.

Implications/Observations:

Although the crypto space has seen three consecutive down months, the market as a whole is still up +74% on the year. In comparison, how have the 2019 Top Ten cryptos done? Up +20%. That’s less than a third of the return of the overall market.

As a reminder, in May 2019, the gains from the Top Ten and the entire market were both exactly the same amount: +114%. The last few months have seen that gap widen: for four straight months, focusing only on the Top Ten has been a losing strategy. This is reminiscent of last year as at no point in the Top Ten 2018 Experiment did the Top Ten strategy outperform the overall market.

I’m also tracking the S&P 500 as part of my experiment to have a comparison point with other popular investments options. The S&P 500 is up +19% since the beginning of 2019. This is now equal to the 2019 Top Ten portfolio, a scenario we haven’t seen since March 2019. For reference, the gap has been extremely wide at different points during the year. For example, the Top Ten portfolio was up +114% compared to +10% for the S&P in late May of this year.

The initial $1k investment I put into crypto would have yielded +$190 had it been redirected to the S&P. This is now approximately equal to the value of the 2019 Top Ten Crypto portfolio.

Conclusion:

September was an eventful month for the Top Ten crypto portfolio: it marked the third straight monthly decline in value; Bitcoin’s dominance finally retreated a bit; and the return of the S&P broke even with the Top Ten portfolio for the first time since March. As we head into the last quarter of the year, can the positive momentum that crypto held earlier in the year be recaptured?

If you’re just finding this experiment now, here’s the backstory: On the 1st of January, 2018, I bought $100 each of the Top Ten cryptos at the time for a total investment of $1000 to see how they would perform over the year. I tracked the experiment and reported each month. The result? I ended 2018 down -85%, my $1000 worth only $150.

After last year’s experiment ended, I decided to do two things:

- Extend the Top Ten 2018 Crypto project one more year. The experiment is now in its 21st month. You can check out the latest update here.

- What you’re reading now is the 9th report of a parallel project: this year I repeated the experiment, purchasing another $1000 ($100 each) of the new Top Ten cryptos as of January 1st, 2019.

Thanks for reading and the support for the experiment. I hope you’ve found it helpful. I continue to be committed to seeing this process through and reporting along the way. Feel free to reach out with any questions and stay tuned for progress reports.

This article contains affiliate links. If you click on a link in this article, I may earn a small commission at no extra cost to you.

Help keep the lights on at the Top Ten Crypto Index Fund Experiments.

Donate directly:

Bitcoin: bc1qqy4tlwydyrm3sjpyyq88es0cu9j9mdvqer3gwv

Ethereum: 0xC04Bc1996320f27c0A6018cB370c9469a9Dd3a4C

ADA: addr1qywnu55t8hpk4c3jf63tj5xywzej0uhwh7yput4u2z3fq7qa8efgk0wrdt3ryn4zh9gvgu9nylewa0ugrchtc59zjpuqlj6stg

XLM: GA5GJ2JDWC3GB3YXEVRBSR7UBLIB2ROIWZ5FEHML5WXGY5N3PAIDEOEA