Month Ten – Up 39%

With each of the 2019 Top Ten Cryptos finishing in the green (except Tether of course, which was flat), October decisively snapped the downward trend we had seen over the three previous months. When Tether finishes last, the portfolio is having a good month.

Overall, the 2019 Top Ten portfolio is up a strong +39% on the year, but no where near the +114% peak this same portfolio achieved at the end of May 2019.

Tied last month with the stock market (as measured by the S&P 500), the 2019 Top Ten Portfolio has regained a healthy lead (see below).

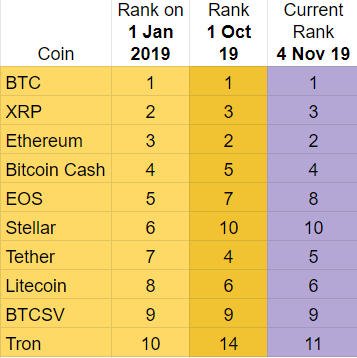

Ranking and October Winners and Losers

It’s almost as if the rankings were reset in October: despite some internal maneuvering (Bitcoin Cash back into fourth place, EOS and Tether both slipping a spot to #8 and #5, respectively), the players remain almost exactly the same. Even Tron, which has slipped out of the Top Ten, is almost back in its original position thanks to a very strong month where it climbed from #14 to #11.

This is quite different from the 2018 Top Ten Experiment where after 10 months four cryptos had convincingly dropped out of the Top Ten. It’s only gotten worse as those four have continued to fall as the 2018 experiment rolls on.

Again, despite its strong October, Tron stands alone as a Top Ten dropout, replaced by Binance Coin.

October Winners – BTCSV gained a massive +50%, easily outperforming the field. Second goes to Tron, up +36%.

October Losers – Tether alone was in the red this month, followed by Ethereum which gained a modest +4%.

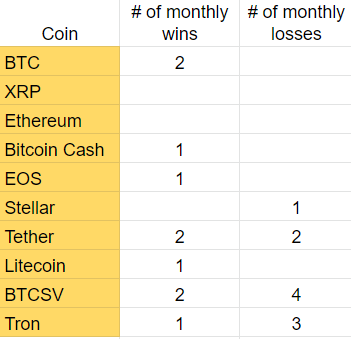

For those keeping score, here is tally of which coins have the most monthly wins and loses during the first ten months of this experiment: a three way tie between Bitcoin, BTCSV, and Tether all with two monthly victories each. Bitcoin SV also has the most monthly loses, finishing last in four out of the first ten months of 2019.

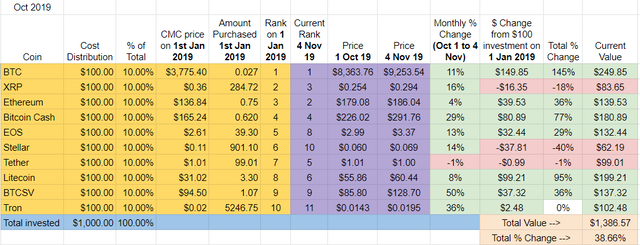

Overall update – Bitcoin with a sizable lead followed by Litecoin. All cryptos in positive territory except Ripple and Stellar.

BTC and Litecoin are still far ahead of their peers, up +145% and +95% respectively in 2019. My initial $100 investment in Bitcoin is now worth $250.

All Top Ten cryptos are still either flat or in positive territory except Ripple and Stellar. Although each increased in value in October, Stellar remains in the basement down -40% so far in 2019, followed by Ripple, down -18%.

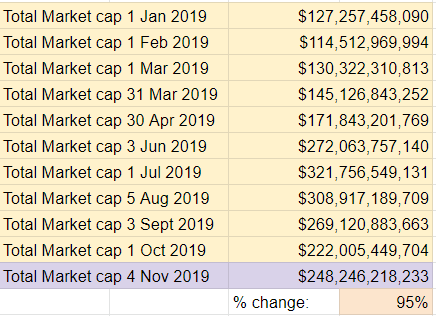

Total Market Cap for the entire cryptocurrency sector:

After three straight losing months, October saw a bounce. The total crypto market cap increased about $26B in October. The overall market cap is sitting around the $248B mark, a level we last saw in September 2019.

Still, it has been a very strong year for crypto: we’ve seen an increase of +95% in total crypto market cap since the beginning of 2019.

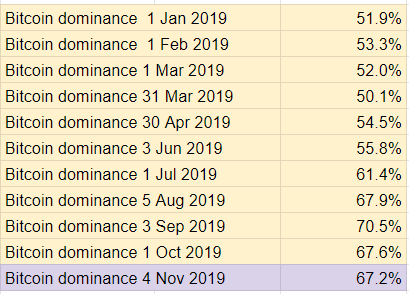

Bitcoin dominance:

Bitcoin dominance ticked down slightly in October, down about -1/2% to 67.2%. The month end high in 2019 was 70.5% in at the end of August.

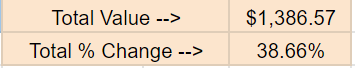

Overall return on investment from January 1st, 2019:

If I cashed out today, my $1,000 initial investment would return $1,386, a +39% gain.

I’m down significantly in my 2018 Top Ten Experiment. If I cashed that group out today, the $1000 initial investment would return about $192, down nearly -81%.

So, taken together, here’s the bottom bottom line: after a $2000 investment in both the 2018 and the 2019 Top Ten Cryptocurrencies, my portfolios would be worth $1,579.

That’s down about -21%.

Implications/Observations:

With the market as a whole up +95% on the year, how have the 2019 Top Ten cryptos performed? Up a respectable but still much lower +39%. As a reminder, in May 2019, the gains from the Top Ten and the entire market were both exactly the same: +114%. The last few months have seen that gap widen: for five straight months, focusing only on the Top Ten has been a losing strategy.

This is reminiscent of last year’s group as at no point in the Top Ten 2018 Experiment did the Top Ten strategy outperform the overall market.

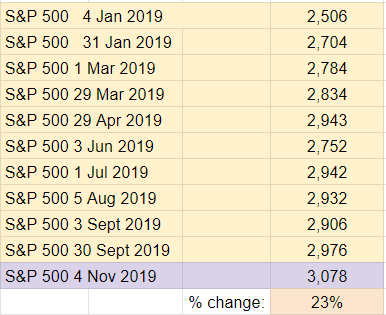

I’m also tracking the S&P 500 as part of my experiment to have a comparison point with other popular investments options. The S&P 500 is up a very healthy +23% since the beginning of 2019, but still much less than the Top Ten of 2019, up +39%.

For reference, the gap has been extremely wide at different points during the year. For example, the Top Ten portfolio was up +114% compared to +10% for the S&P in late May of this year.

The initial $1k investment I put into crypto would have yielded +$230 had it been redirected to the S&P.

Conclusion:

Probably due to the news out of China, October saw a welcome reversal of a multi month slide in crypto. The last few months of the year have been busy in recent history. Around this time of year two years ago, the market started skyrocketing while last year it started to slide. We’ll soon see which of these histories repeat itself or if crypto has something altogether different in store.

If you’re just finding this experiment now, here’s the backstory: On the 1st of January, 2018, I bought $100 each of the Top Ten cryptos at the time for a total investment of $1000 to see how they would perform over the year. I tracked the experiment and reported each month. The result? I ended 2018 down -85%, my $1000 worth only $150.

After last year’s experiment ended, I decided to do two things:

- Extend the Top Ten 2018 Crypto project one more year. The experiment is now in its 22nd month. You can check out the latest update here.

- What you’re reading now is the 10th report of a parallel project: this year I repeated the experiment, purchasing another $1000 ($100 each) of the new Top Ten cryptos as of January 1st, 2019.

Thanks for reading and the support for the experiment. I hope you’ve found it helpful. I continue to be committed to seeing this process through and reporting along the way. Feel free to reach out with any questions and stay tuned for progress reports.

This article contains affiliate links. If you click on a link in this article, I may earn a small commission at no extra cost to you.

Help keep the lights on at the Top Ten Crypto Index Fund Experiments.

Donate directly:

Bitcoin: bc1qqy4tlwydyrm3sjpyyq88es0cu9j9mdvqer3gwv

Ethereum: 0xC04Bc1996320f27c0A6018cB370c9469a9Dd3a4C

ADA: addr1qywnu55t8hpk4c3jf63tj5xywzej0uhwh7yput4u2z3fq7qa8efgk0wrdt3ryn4zh9gvgu9nylewa0ugrchtc59zjpuqlj6stg

XLM: GA5GJ2JDWC3GB3YXEVRBSR7UBLIB2ROIWZ5FEHML5WXGY5N3PAIDEOEA