This article contains affiliate links. If you click on a link in this article, I may earn a small commission at no extra cost to you.

Recommended Storage:

For crypto storage, my recommended hardware wallet is the Ledger Nano X.

Recommended Exchange:

On solid financial footing and ready to purchase crypto? My recommended exchange is Binance.

Get up to $59 of FREE COMP with Coinbase Earn

AND Get up to $50 of FREE XLM with Coinbase Earn

Considering getting into cryptocurrencies?

Be prepared for a wild ride.

In fact, I recommend getting your financial house in order first.

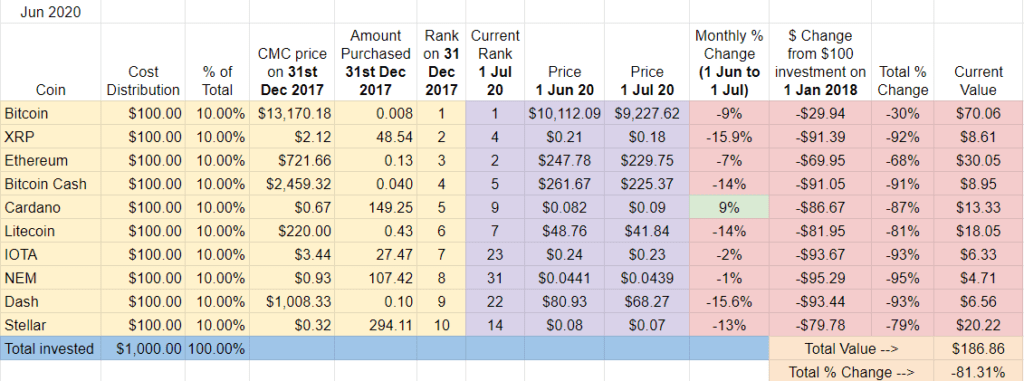

Month Thirty – Down 81%

After two consecutive strong months, the 2018 Top Ten Crypto Index Fund Portfolio lost some ground in June. In a sea of red, there was one bright spot: Cardano finished the month up +9%.

Question of the month:

The 2018 Crypto Index Fund Experiment began January 1st, 2018. Which of the Top Ten cryptos performed best at the end of year one?

A) Bitcoin

B) Ethereum

C) Bitcoin Cash

D) Stellar

Scroll down for the answer.

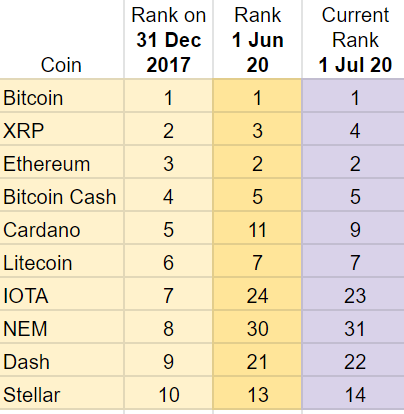

Ranking and June Winners and Losers

There was a lot of movement with the 2018 Top Ten group this month. For the second month in a row, Cardano made the most upward progress, climbing two positions to reclaim its spot in the Top Ten at #9. By basically finishing the month flat, IOTA picked up one spot in the standings as well. Heading the other direction, XRP, NEM, Dash, and Stellar each fell one place in the rankings.

Thanks to Cardano’s strong month, the overall drop out rate shrank to 40%. In other words, four out of the ten cryptos that started 2018 in the Top Ten have dropped out. NEM, Dash, IOTA, and Stellar have been replaced by Binance Coin, Tether, BSV, and newcomer Crypto.com Coin (oh, hello CRO, where did you come from?).

June Winners – Winner, singular: ADA, for the second month in a row, up +9% while the rest of the field sank or held ground. After a great spring, Cardano’s summer is off to a strong start.

June Losers – For the second month in a row, XRP was the worst performer, down -15.9%. Close behind was Dash, down -15.6% in June.

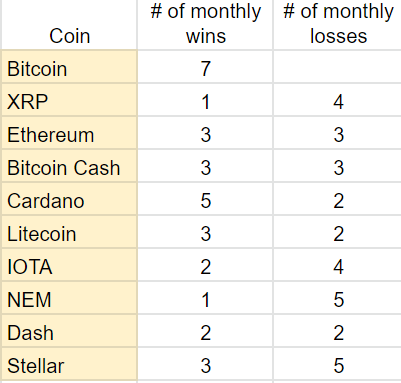

How has your favorite crypto fared over the first 30 months of the 2018 Top Ten Crypto Index Fund Experiment? Most monthly wins (7): Bitcoin followed by Cardano with 5 monthly wins. The most monthly losses? A tie between Stellar and NEM, both with 5. All cryptos have at least one monthly win and Bitcoin stands alone as the only crypto that hasn’t lost a month (although it came close in January 2020 when it gained “only” +31%).

Overall update – BTC returning twice as much second place ETH, NEM in basement.

Although down -30% since January 2018, BTC is still well ahead of the rest of the pack. My initial investment of $100 is now worth about $70.

Ethereum is all alone in second place, down -68%, the initial $100 investment worth about $30.

NEM (down -95%) is still in last place. That initial $100 investment in NEM? Now worth $4.71.

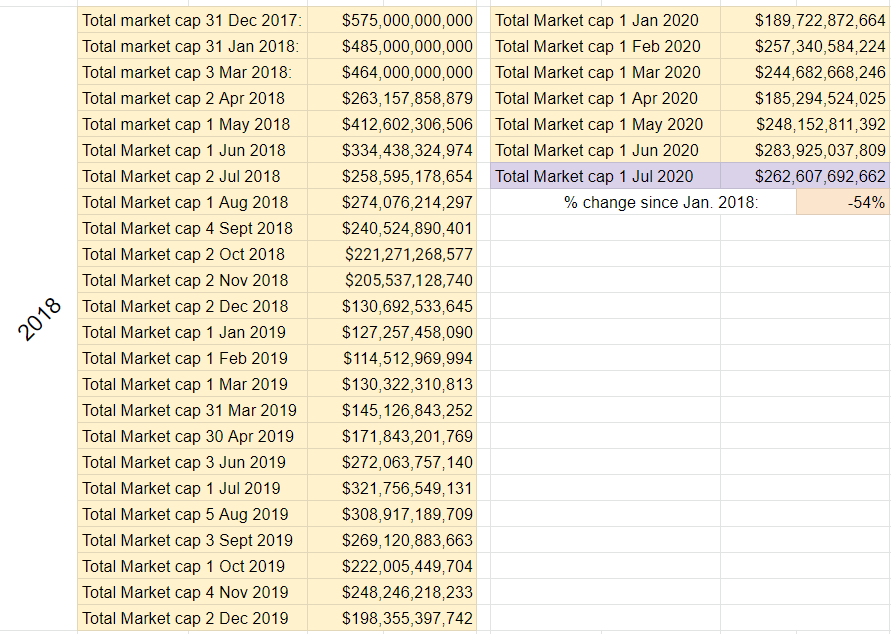

Total Market Cap for the entire cryptocurrency sector:

The crypto market as a whole lost about $21B in June. This is down over half from January 2018 when the market was worth roughly $575B.

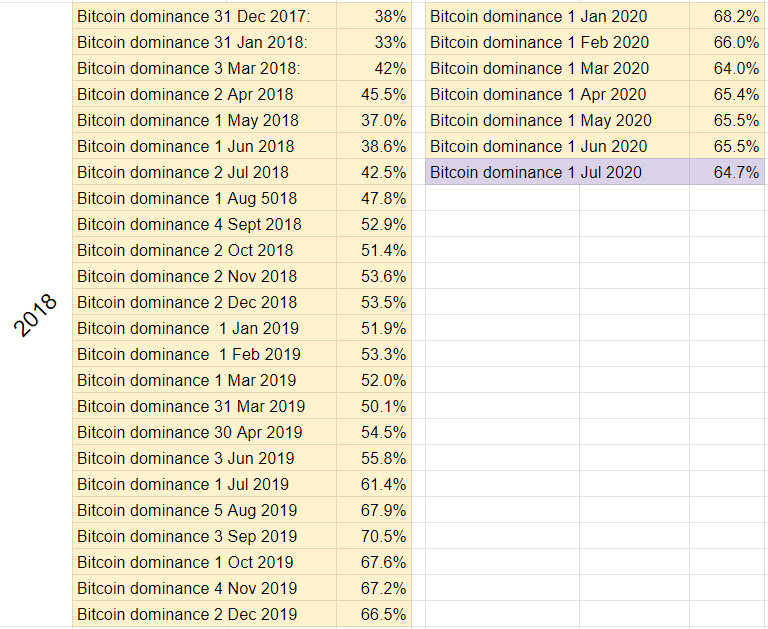

Bitcoin dominance:

After three months of zero movement, Bitcoin dominance finally declined, but not by much. It’s been stuck in the mid-60s to low-70s range for the past year.

Since the beginning of the experiment, the range of Bitcoin dominance has been quite wide: we saw a high of 70% BitDom in September 2019 and a low of 33% BitDom in February 2018.

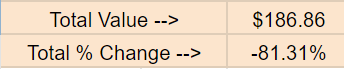

Overall return on investment since January 1st, 2018:

The 2018 Top Ten Portfolio lost about $20 bucks in June 2020. If I cashed out today, my $1000 initial investment would return about $187, down -81% from January 2018.

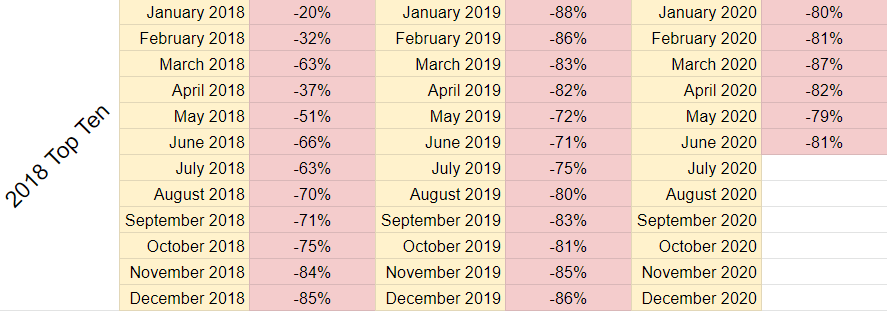

Here’s the ROI over the life of the experiment, month by month:

After a brief dip last month into the negative seventies, we’re back down to the very familiar negative eighties.

Fun fact: over the course of the 2.5 years since the beginning of the 2018 Top Ten Index Fund Experiment, the portfolio has finished over half of the first thirty months down at least -80%.

Tracking the Top Ten cryptos from January 1st, 2018 has been an undoubtedly painful exercise so far. But what about 2019 and 2020 when I repeated the experiment? Let’s take a look:

- 2019 Top Ten Experiment: up +25.9% ($1,259)

- 2020 Top Ten Experiment: up +26.3% ($1,264)

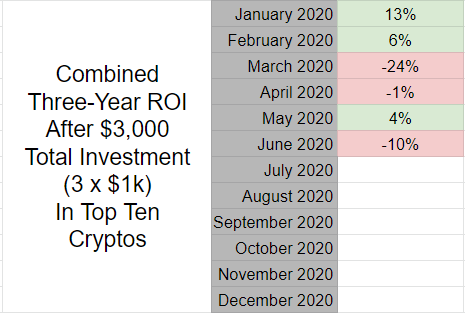

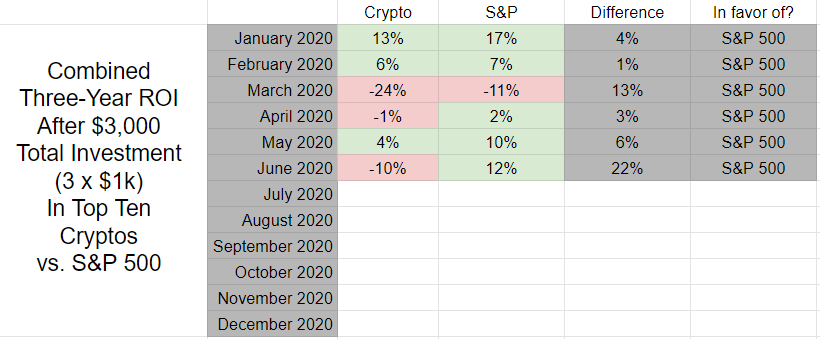

So overall? Taking the three portfolios together, here’s the bottom bottom bottom line:

After a $3000 investment in the 2018, 2019, and 2020 Top Ten Cryptocurrencies, my combined portfolios are worth $2,710.

That’s down about -10% for the three combined portfolios. That’s compared to about +4% last month. Better than a few months ago (aka the zombie apocalypse) where it was down -24%, but not yet back at January (+13%) or February (+6%) levels.

Having trouble keeping up? Yeah, me too. You know what that means?!?!?! NEW TABLE DROP!!

Ah, that’s better. Much better.

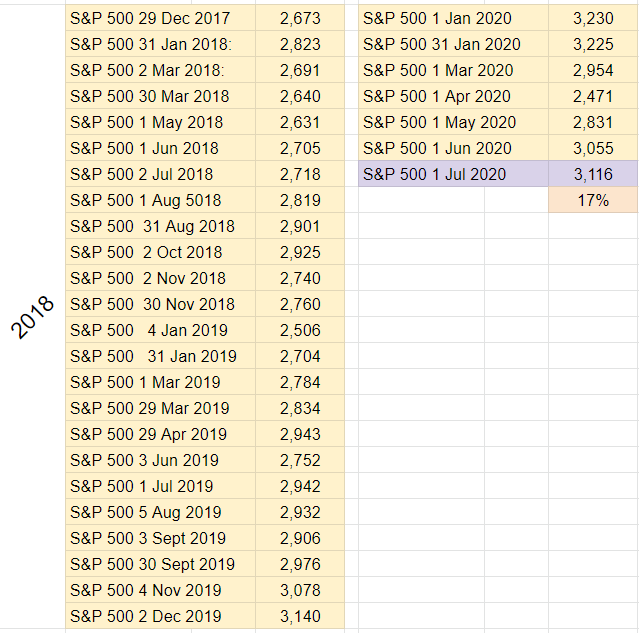

Comparison to S&P 500:

I’m also tracking the S&P 500 as part of the experiment to have a comparison point with other popular investments options. Even though the US economy is still reeling from the COVID shock, the stock market (as measured by the S&P) continued to recover in June. The initial $1k investment into crypto on New Year’s Day 2018 would have gained about $170 had it been redirected to the S&P.

Alright, let’s compare all three years of the crypto investments to hypothetical US stock market investments. Taking the same drop-$1,000-per-year-on-January-1st-of-each-year approach with the S&P 500 that I’ve been documenting through the Top Ten Crypto Experiments would yield the following:

- $1000 investment in S&P 500 on January 1st, 2018: +$170

- $1000 investment in S&P 500 on January 1st, 2019: +$240

- $1000 investment in S&P 500 on January 1st, 2020: -$40

Taken together, here’s the bottom bottom bottom line for a similar approach with the S&P:

After three $1,000 investments into an S&P 500 index fund in January 2018, 2019, and 2020, my portfolio would be worth $3,370.

That is up over+12% since January 2018, compared to -10% of the combined Top Ten Crypto Experiment Portfolios.

That’s about a 22% swing in favor of the stock market, the widest so far this year. Last month, there was only a 6% difference in favor of the stock market. Here’s another new table that shows an emerging pattern:

Implications/Observations:

The 2018 Experiment’s focus of solely holding the Top Ten Cryptos has not (and has never been) a winning approach when compared to the overall crypto market. The total market cap is down -54% from January 2018 compared to the -81% for the cryptos that began 2018 in the Top Ten.

This of course implies that I would have done a bit better if I’d picked every crypto, or different cryptos: throwing that $1k to Bitcoin, for example, would have me down by -30% instead of -81%.

On the other hand, this bit of diversification has served me well compared to putting all my eggs in NEM‘s -95% basket, for example.

To reiterate, at no point in this experiment has this investment strategy been successful: the initial 2018 Top Ten have under-performed each of the first thirty months compared to the market overall.

Repeating the Top Ten experiments in 2019 and 2020 has resulted in a slightly different story. There are a few examples of this approach outperforming the overall market in the parallel 2019 Top Ten Crypto Experiment. And for the most recent 2020 Top Ten Index Fund group of cryptocurrencies, this approach had outperformed the overall market 100% of the time…up until the last two months.

Conclusion:

We’re half way through a very strange year, where it seems we’re playing Biblical Plague Bingo. The US market have more or less bounced back from the shock, crypto markets to a lesser degree. What’s next for crypto in an extremely unpredictable year?

Final word: Be excellent to each other.

Thanks for reading and for supporting the experiment. I hope you’ve found it helpful. I continue to be committed to seeing this process through and reporting along the way. Feel free to reach out with any questions and stay tuned for progress reports. Keep an eye out for my parallel projects where I repeat the experiment twice, purchasing another $1000 ($100 each) of two new sets of Top Ten cryptos as of January 1st, 2019 then again on January 1st, 2020.

And the Answer is…

D) Stellar

Even though it finished the year down -66%, Stellar outperformed the rest of the 2018 Top Ten Index Fund Experiment Cryptos after the first 12 months. Second place on January 1st, 2019 was Bitcoin, down -71%.

Help keep the lights on at the Top Ten Crypto Index Fund Experiments.

Donate directly:

Bitcoin: 1Pwz1gABZd2jkfFrjSZbJmD3te3dFYjhJo

Ripple: rEVxyudxYfPDFiV9qVZU8m7v2w9vwc4UCj

Ethereum: 0xf1df4ae19e80dd195ac67281598d84C4D6df029f

Pingback: I bought $1k of the Top Ten Cryptos on January 1st, 2018. Result? -74% | Crypto Basset Hound

Pingback: r/CryptoCurrency - I bought $1k of the Top Ten Cryptos on January 1st, 2018. Result? -74% | Cryptocurrency News

Pingback: I bought $1k of the Top Ten Cryptos on January 1st, 2018. Result? -74% : CryptoCurrency | https://cryptoyaks.com

Pingback: I bought $1k of the Top Ten Cryptos on January 1st, 2018. Result? Down -81% - Crypto: News, Games and more stuff

Pingback: I bought $1k of the Top Ten Cryptos on January 1st, 2018. Result? Down -81% : CryptoCurrency | https://cryptoyaks.com

Pingback: /u/Joe-M-4I bought $1k of the Top Ten Cryptos on January 1st, 2018. Result? Down -81%top scoring links : CryptoCurrency – Crypto Coin Chance

Pingback: I bought $1k of the Top Ten Cryptos on January 1st, 2018. Result? Down -81% | News