Ways to pick up free Bitcoin:

Method #1: Open an Uphold wallet using this link. Buy or sell $250 in crypto in the first 30 days, get $20 in free BTC.

Method #2: Sign up for Nexo using this link. Top up your account with $500 in crypto and complete a few tasks. Make sure your assets are still worth $500 in 30 days and you will receive $35 in free BTC.

Method #3: Open a Coinbase account using this link. Buy $20 in crypto, get $20 in free BTC.

Happy HODLING!

Month Twenty-Two – Down -68%

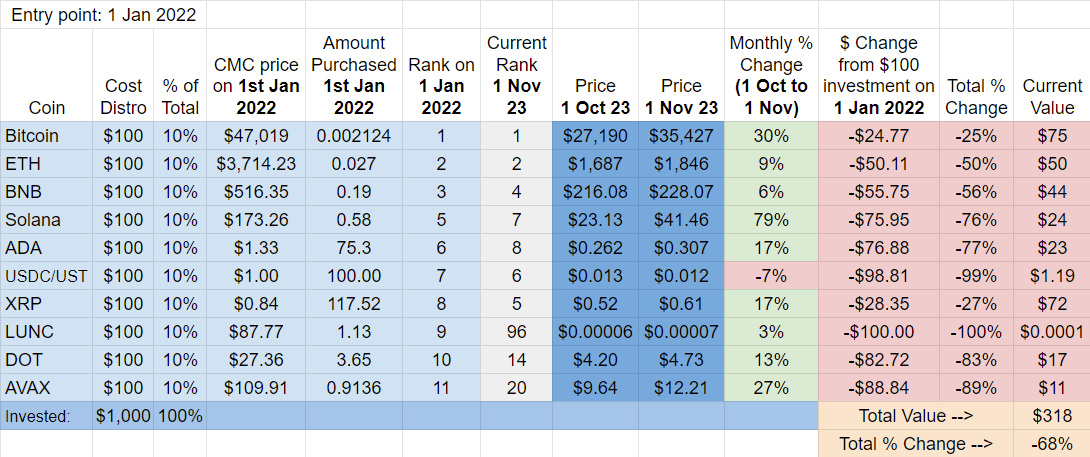

The 2022 Top Ten Crypto Index Fund Portfolio is BTC, ETH, BNB, Solana, ADA, USDC/UST, XRP, LUNA/LUNC, DOT, AVAX.

October highlights for the 2022 Top Ten Portfolio:

- Solana significantly outperforms the field, finishing the month +79%

- Although still -25%, BTC’s strong October propel it past XRP for first place overall.

- The 2022 Top Ten Portfolio is the worst performing of the six Top Ten experiments, -68% as a whole.

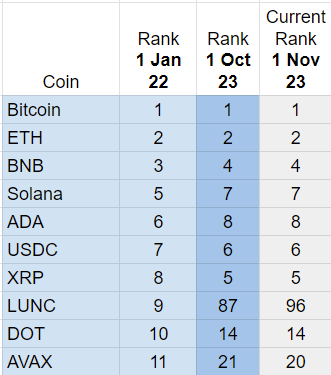

October Ranking and Dropouts

Here’s a look at the movement in ranking twenty-two months into the 2022 Top Ten Index Fund Experiment:

AVAX, DOT, and LUNC have dropped out, replaced by Tron, DOGE, and LINK.

October Winners and Losers

October Winners – SOL (+79%) easily won in October, followed by BTC (+30%) and AVAX (+27%)

October Losers – Just one: UST, down -7% this month.

Overall Update: BTC overtakes both XRP and BNB for the overall lead. All cryptos are well in negative territory. LUNC worst performing in the 2022 Portfolio and worst performing crypto of all the Top Ten Experiments.

BTC (-25%) overtook both XRP (-27%) and BNB (-56%) since the last 2022 Top Ten Report. ETH (-50%) has also made up significant ground, but is still a long way from break even point.

Ever since LUNC’s (then known as LUNA) crash in May of 2022, it has remained hopelessly at the bottom, worth a fraction of a cent. The initial $100 invested in Luna twenty-two months ago is worth $0.0001 today – the worst performance of any coin in any of the six Top Ten Experiments, by far. It’s hard to remember/believe that LUNA was the highest performing Top Ten Crypto of the first quarter of 2022.

At -68%, the 2022 Top Ten Portfolio is the worst performing of the six Top Ten experiments.

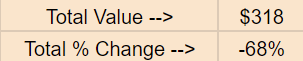

Overall return on $1,000 investment since January 1st, 2022:

Overall, the 2022 Top Ten Portfolio is down -68%. The initial $1000 investment on New Year’s Day 2022 is now worth $318.

Here’s a visual summary of the progress so far:

As you can see, there hasn’t been a positive overall ROI month yet, although the 2022 Top Ten Portfolio flirted with the break even point in March 2022. The value has remained in the -66% to -80% range since May 2022.

A note on USDC/UST

In retrospect this was not my best idea: I was a bit bored of simply holding a stablecoin in the Top Ten as I’ve been doing since 2019 and thought I’d showcase some of the possibilities available in crypto to build on stablecoin holdings. My plan was to start nice and easy with trusted CeFi platforms, taking advantage of sign up bonuses, then move to more advanced DeFi strategies. As fate would have it, I decided to showcase the TerraLuna chain converting my USDC to UST and then staking with Anchor.

It was all going pretty well until May 2022. Then the LUNA implosion happened. My UST is now worth $0.0001, down -100%.

It’s a good reminder that anything can and does happen in crypto and we should all continue to be careful. I’m thankful that the lesson only cost me $100: I know a lot of other people got hit much, much harder.

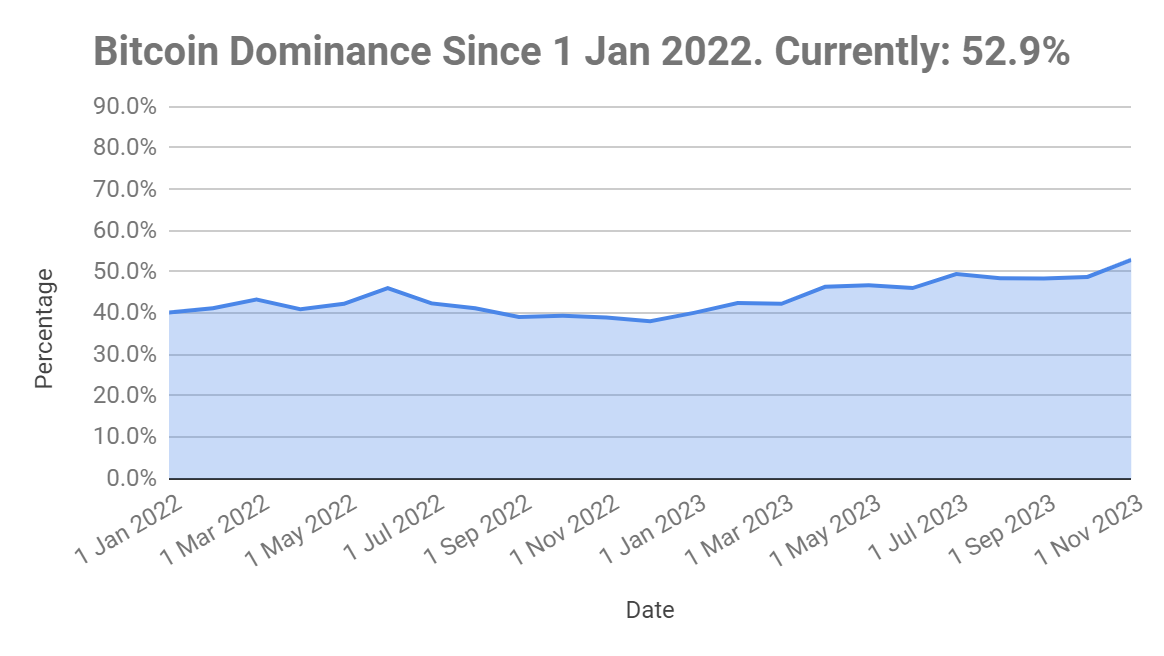

Bitcoin Dominance:

BitDom ended October at 52.9%, the highest level since January 2022. Chart below:

For those just getting into crypto, it’s worth paying attention to the Bitcoin dominance figure, as it can signal appetite for altcoins vs. BTC.

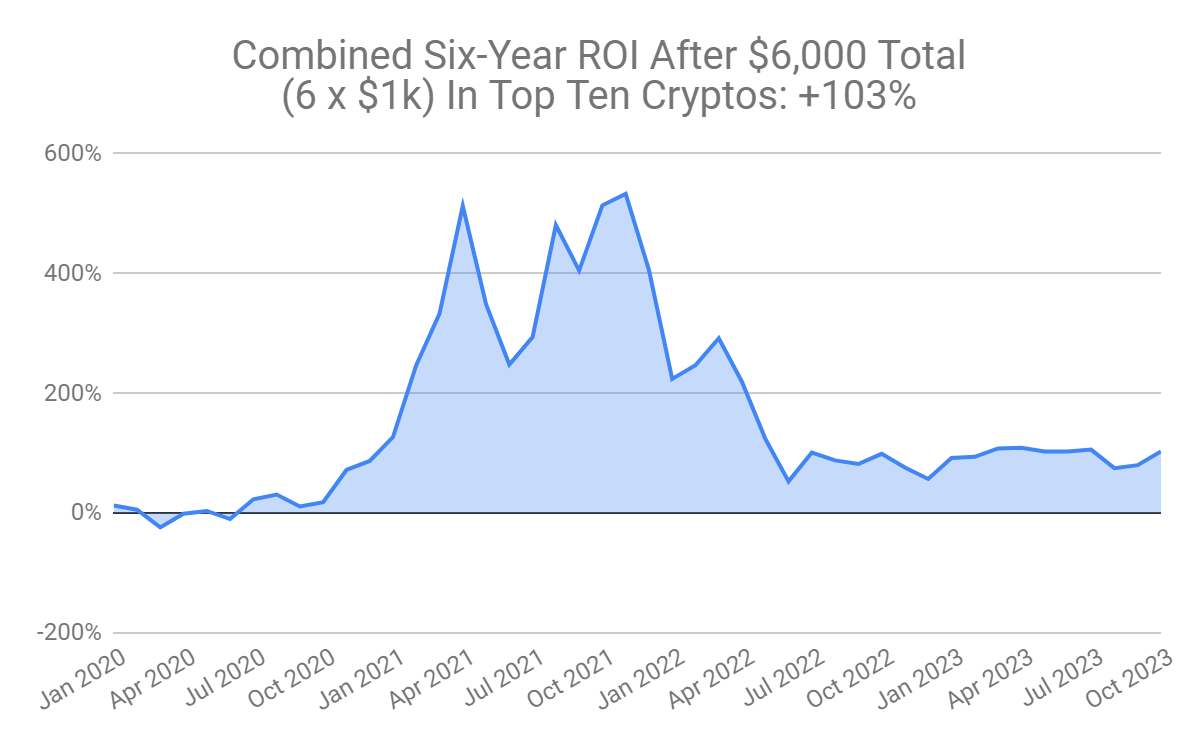

Combining the 2018, 2019, 2020, 2021, 2022, and 2023 Top Ten Crypto Portfolios

The 2022 Top Ten is one of six concurrent experimental portfolios. Where do we stand if we combine six years of the Top Ten Crypto Index Fund Experiments?

- 2018 Top Ten Experiment: down -31% (total value $690)

- 2019 Top Ten Experiment: up +271% (total value $3,713)

- 2020 Top Ten Experiment: up +341% (total value $4,407) (best performing portfolio)

- 2021 Top Ten Experiment: up +77% (total value $1,768)

- 2022 Top Ten Experiment: down -68% (total value $318) (worst performing portfolio)

- 2023 Top Ten Experiment: up +27% (total value $1,268)

Taking the six portfolios together, here’s the bottom bottom bottom bottom bottom bottom line:

After a $6,000 total investment in the 2018, 2019, 2020, 2021, 2022, and 2023 Top Ten Cryptocurrencies, the combined portfolios are worth $12,164.

That’s up +103% on the combined portfolios. The peak for the combined Top Ten Index Fund Experiment Portfolios was November 2021’s all time high of +533%. Here’s the combined monthly ROI since I started tracking the metric in January 2020 for those who do better with visuals:

In summary: That’s a +103% gain by investing $1k on whichever cryptos happened to be in the Top Ten on January 1st (including stablecoins) for six straight years.

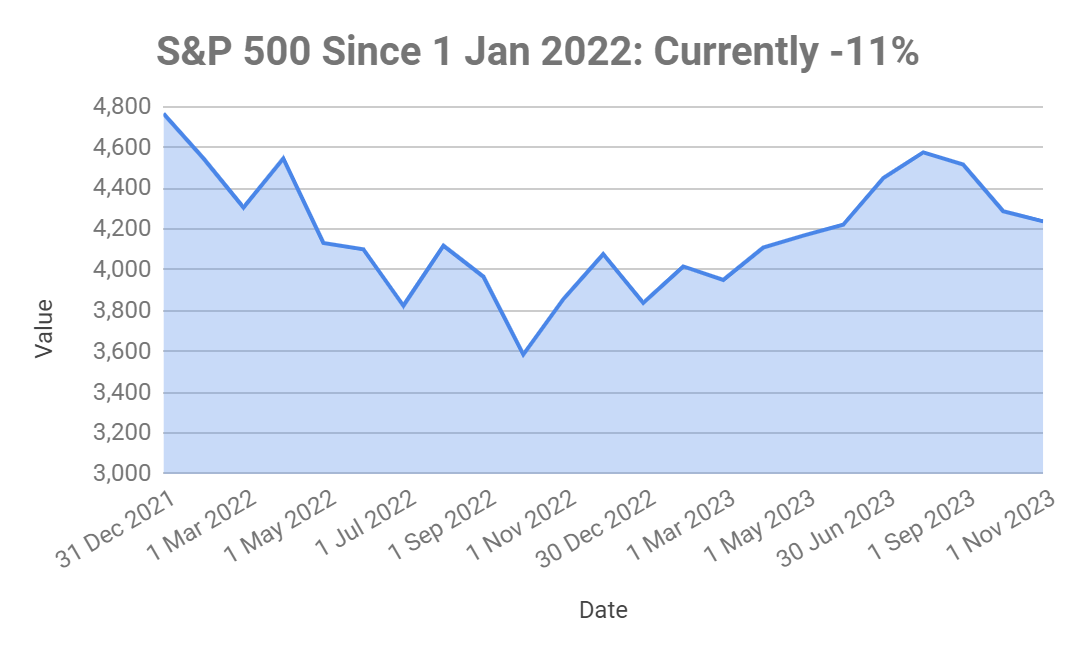

Comparison to S&P 500

I’m also tracking the S&P 500 as part of my Experiment to have a comparison point to traditional markets.

The S&P 500 is down -11% since January 2022, so the initial $1k investment into crypto on New Year’s Day would be worth $890 had it been redirected to the S&P.

Taking the same invest-$1,000-on-January-1st-of-each-year approach with the S&P 500 that I’ve been documenting through the Top Ten Crypto Experiments, the yields are the following:

- $1000 investment in S&P 500 on January 1st, 2018 = $1,590 today

- $1000 investment in S&P 500 on January 1st, 2019 = $1,690 today

- $1000 investment in S&P 500 on January 1st, 2020 = $1,310 today

- $1000 investment in S&P 500 on January 1st, 2021 = $1,130 today

- $1000 investment in S&P 500 on January 1st, 2022 = $890 today

- $1000 investment in S&P 500 on January 1st, 2023 = $1,100 today

Taken together, here’s the bottom bottom bottom bottom bottom bottom line for a similar approach with the S&P:

After six $1,000 investments into an S&P 500 index fund in January 2018, 2019, 2020, 2021, 2022, and 2023 my portfolio would be worth $7,710.

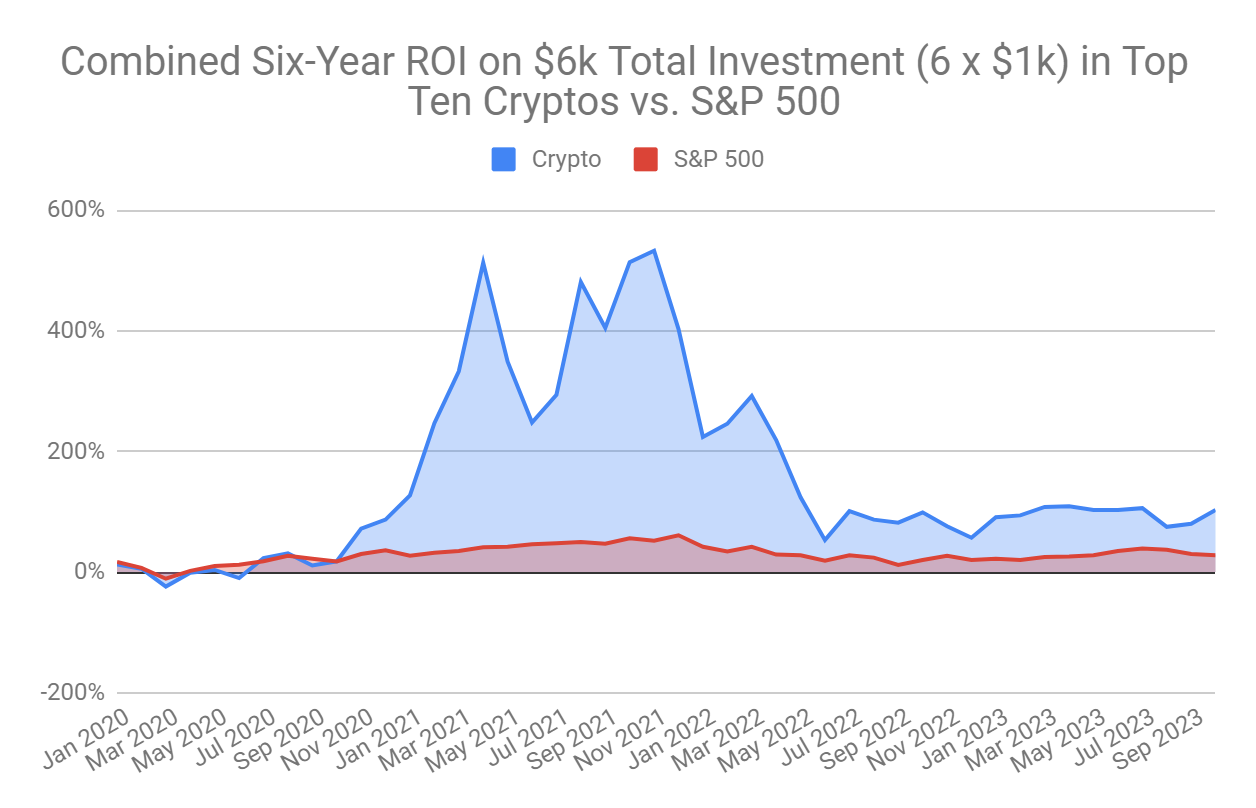

That is up +28% since January 2018 compared to a +103% gain of the combined Top Ten Crypto Experiment Portfolios.

The visual below shows a comparison on ROI between a Top Ten Crypto approach and the S&P as per the rules of the Top Ten Experiments:

Conclusion:

As the last section demonstrates, if you can stomach crypto’s volatility (a big if) over the past few years, you’ll find better overall returns in crypto vs. traditional markets – at least at this point in the Experiment.

To the long time followers of the Top Ten Experiments, thank you for sticking around so long. For those just getting into crypto, I hope these reports will help prepare you for the highs and lows that await on your crypto adventures. Buckle up, go with the flow, think long term, and truly don’t invest what you can’t afford to lose. Most importantly, try to enjoy the ride.

A reporting note: I’ll focus on 2023 Top Ten Portfolio reports + one other portfolio on a rotating basis this year, so expect two reports per month. October’s extended report covers the 2022 Top Ten Portfolio, which you are reading now. You can check out the latest 2018 Top Ten, 2019 Top Ten, 2020 Top Ten, and 2021 Top Ten reports as well.

This article contains affiliate links. If you click on a link in this article, I may earn a small commission at no extra cost to you.

Help keep the lights on at the Top Ten Crypto Index Fund Experiments.

Donate directly:

Bitcoin: bc1qqy4tlwydyrm3sjpyyq88es0cu9j9mdvqer3gwv

Ethereum: 0xC04Bc1996320f27c0A6018cB370c9469a9Dd3a4C

ADA: addr1qywnu55t8hpk4c3jf63tj5xywzej0uhwh7yput4u2z3fq7qa8efgk0wrdt3ryn4zh9gvgu9nylewa0ugrchtc59zjpuqlj6stg

XLM: GA5GJ2JDWC3GB3YXEVRBSR7UBLIB2ROIWZ5FEHML5WXGY5N3PAIDEOEA

Pingback: I bought $1k of the Top 10 Cryptos on January 1st, 2022 (OCTOBER Update/Month 22/-68%) - NFT-BOX