This article contains affiliate links. If you click on a link in this article, I may earn a small commission at no extra cost to you.

Month Seven – UP 214%

The 2021 Top Ten Index Fund recovered nicely from June’s all-red performance. This portfolio gained about $300 in July and all coins were either flat or in positive territory with LINK leading the way.

July Movement Report, Ranking, and Dropouts

Very little movement to report this month with the 2021 Top Ten Portfolio:

Ups:

- XRP – up one place (#7–>#6)

- LINK – up two places (#15–>#13)

Downs:

- Litecoin – down one place (#14–>#15)

Top Ten dropouts since January 2021: Seven months into the 2021 Top Ten Experiment, three cryptos have dropped out: Chainlink, Litecoin, and Bitcoin Cash. They have been replaced by UNI, DOGE, and USDC.

July Winners and Losers

July Winners – LINK had a very strong month, returning +23% and outperforming its peers. Ethereum finished a close second place, up +21% in July.

July Losers – ADA lost -1% of its value in July making it the worst performer and the only crypto that finished in the red this month.

Tally of Monthly Winners and Losers

Seven months into the Experiment, here’s where we stand in terms of the 2021 Top Ten Portfolio’s monthly winners and losers:

ADA and BNB are tied for the lead with two monthly victories each. Cardano leads the loss column as well (tied with UST). Swing trade anyone?

Overall Update – BNB flips ADA for the lead, all cryptos in green, Litecoin lagging in 2021.

Two months after Cardano flipped Binance Coin, BNB (+757%) has regained the lead, convincingly re-flipping second place ADA +633%) in July.

The $100 investment into first place BNB seven months ago is now worth $860.

Besides Tether, Litecoin is the worst performing cryptocurrency of the 2021 Top Ten Portfolio, up a mere +11% in 2021.

Total Market Cap for the Entire Cryptocurrency Sector:

A solid recovery in July, crypto added $223 billion this month, finishing at $1.6T mark. The total market cap is up +106% since the beginning of the year.

You may notice that the 2021 Top Ten Portfolio is returning over double the overall crypto market cap (+214% vs. +106%) so far in 2021.

This is a bit of an outlier: the rest of the Top Ten Experiments are well behind what the overall market has returned in their respective time frames. Although the 2021 Top Ten approach has held up quite well compared to the overall market so far, I expect to see it fall behind eventually, like the other experiments.

Low Point in the 2021 Top Ten Crypto Index Experiment: $775B in January 2021.

High Point in the 2021 Top Ten Crypto Index Experiment: $2.2T in April 2021.

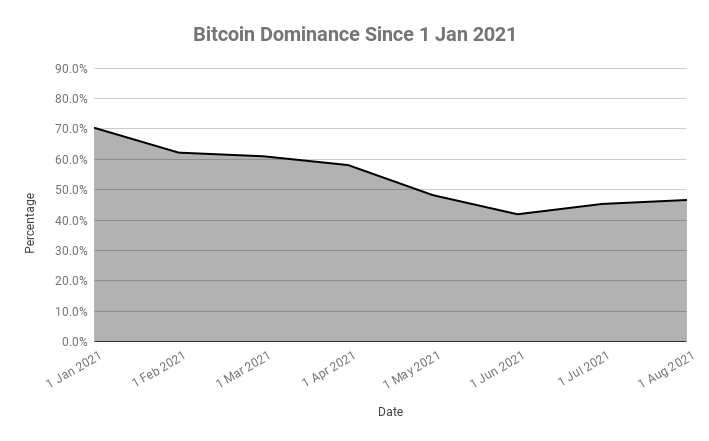

Bitcoin Dominance:

BitDom continued to rebound in July, up from a 2021 Experiment low two months ago. It currently sits at 46.6%.

Low Point in the 2021 Top Ten Crypto Index Experiment: 42% in May 2021.

High Point in the 2020 Top Ten Crypto Index Experiment: 70% in January 2021.

Overall return on $1,000 investment since January 1st, 2021:

The 2021 Portfolio gained nearly $300 in July. Overall, the 2021 Top Ten Portfolio is up +214%, the initial $1000 investment on New Year’s Day 2021 worth $3,137.

Here’s the month by month ROI of the 2021 Top Ten Experiment, to give you a sense of perspective and provide an overview as we go along:

The 2021 Top Ten Portfolio has had the best start, by far, of any of the four Top Ten Crypto Experiments.

Combining the 2018, 2019, 2020, and 2021 Top Ten Crypto Portfolios

As most readers are aware, this is the fourth year of an Experiment I started back in January of 2018, at the height of the last bull run. Where do we stand if we combine four years of the Top Ten Crypto Index Fund Experiments?

- 2018 Top Ten Experiment: up 12% (total value $1,116)

- 2019 Top Ten Experiment: up +398% (total value $4,984)

- 2020 Top Ten Experiment: up +552% (total value $6,524)

- 2021 Top Ten Experiment: up +214% (total value $3,137)

Taking the four portfolios together, here’s the bottom bottom bottom bottom line:

After a $4,000 investment in the 2018, 2019, 2020, and 2021 Top Ten Cryptocurrencies, the combined portfolios are worth $15,761 ($1,116 + $4,984 + $6,524 + $3,137).

That’s up +294% when you put all four Top Tens together.

Here’s a table to help visualize the progress of the combined portfolios:

That’s a +294% gain by investing $1k into the cryptos that happened to be in the Top Ten on January 1st, 2018, 2019, 2020, and 2021.

Top Ten Index vs. Top Three Index

Inspired by a suggestion from one of our blog readers, let’s take a look at how the 2021 Top Ten approach would compare to just focusing on the Top Three.

I crunched the numbers, and to make it more interesting, I removed Tether from the index and pulled #4 into the Top Three.

A Top Three Index (minus Tether, plus XRP) would mean $333 into BTC, ETH, and XRP.

A hypothetical Top Three Index would be worth $2,668, returning +167%. That’s compared to the $3,137 (+214%) return of the 2021 Top Ten.

At this point in the 2021 Experiment, it would have been better to go with a Top Ten Index approach instead of focusing on the Top Three.

Comparison to S&P 500

I’m also tracking the S&P 500 as part of my experiment to have a comparison point to traditional markets. Yet another all time high for the S&P in July:

The S&P 500 Index is up 17% in 2021. The initial $1k investment I put into crypto seven months ago would be worth $1,170 had it been redirected to the S&P 500.

The 2021 Top Ten Crypto Portfolio is up +214% over the same time period. Just over a half a year in, the initial $1k investment in crypto is now worth $3,137.

That’s a difference of $1,967 on a $1k investment in seven months.

What about in the longer term? What if I invested in the S&P 500 the same way I did during the first four years of the Top Ten Crypto Index Fund Experiments? What I like to call the world’s slowest dollar cost averaging method? Here are the figures:

- $1000 investment in S&P 500 on January 1st, 2018 = $1640 today

- $1000 investment in S&P 500 on January 1st, 2019 = $1750 today

- $1000 investment in S&P 500 on January 1st, 2020 = $1360 today

- $1000 investment in S&P 500 on January 1st, 2021 = $1170 today

Taken together, here’s the bottom bottom bottom bottom line for a similar approach with the S&P:

After four $1,000 investments into an S&P 500 index fund in January 2018, 2019, 2020, and 2021, my portfolio would be worth $5,920 ($1,640 + $1,750 + $1,360 + $1,170)

That is up +48% since January 2018 compared to a +294% gain of the combined Top Ten Crypto Experiment Portfolios, a difference of 246% in favor of crypto.

To help provide perspective, here’s a quick look at the combined four year ROI for crypto vs. the S&P up to this point.

Conclusion:

A solid bounce back after June’s first all red month of the 2021 Experiment. The newest group of ten cryptos is performing extremely well, up +214% since the beginning of the year. Out of the Four Top Ten Experiments, it is the only portfolio that is performing better than the overall crypto market.

Alright – was that it? Was that just a mid-cycle correction like some of the crypto tea leaf readers were saying? It’s looking like it at the moment, but I’ll personally be more convinced after a few more green months.

To the long time followers of the Top Ten Experiments, thank you so much for sticking around so long. For those just getting into crypto, I hope these reports will help prepare you for the highs and lows that await on your crypto adventures. Buckle up, go with the flow, think long term, don’t invest what you can’t afford to lose, and most importantly, try to enjoy the ride! Feel free to reach out with any questions and stay tuned for progress reports. Keep an eye out for my parallel projects tracking the Top Ten cryptos as of January 1st, 2018 (the OG Experiment), January 1st, 2019, and January 1st, 2020.

This article contains affiliate links. If you click on a link in this article, I may earn a small commission at no extra cost to you.

Help keep the lights on at the Top Ten Crypto Index Fund Experiments.

Donate directly:

Bitcoin: bc1qqy4tlwydyrm3sjpyyq88es0cu9j9mdvqer3gwv

Ethereum: 0xC04Bc1996320f27c0A6018cB370c9469a9Dd3a4C

ADA: addr1qywnu55t8hpk4c3jf63tj5xywzej0uhwh7yput4u2z3fq7qa8efgk0wrdt3ryn4zh9gvgu9nylewa0ugrchtc59zjpuqlj6stg

XLM: GA5GJ2JDWC3GB3YXEVRBSR7UBLIB2ROIWZ5FEHML5WXGY5N3PAIDEOEA

Pingback: $1k invested into the Top Ten Cryptos in January 2021 – UP +422% (AUG Update – Month 8) – DarkFiberMines.com

Pingback: $1k invested into the Top Ten Cryptos in January 2021 - UP +422% (AUG Update - Month 8) - WORK 4 BTC

Pingback: $1k invested into the Top 10 Cryptos on January 1st, 2020 Up +552% (July Update – Month 19) – DarkFiberMines.com

I like your job but i don’t understand one thing. You sell and buy every month the top ten crypto or you hold it?

I wish you can understand me, sorry but i’m from italy and mu english is not very well. Thx for the reply

Once per year on 1 January. 10x$100=$1000 on 1 January 2018 and again 2019, 2020, 2021. $4000 total.

Pingback: I bought $1k of the Top 10 Cryptos on January 1st, 2019 (JULY Update/Month 31) UP +398% – DarkFiberMines.com