Month Three – Up 16.6%

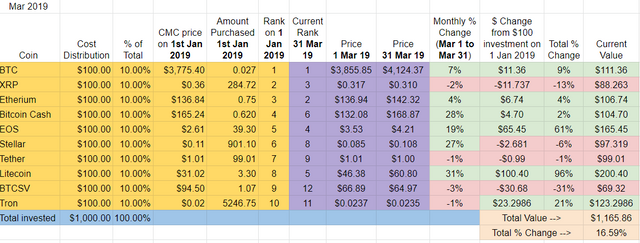

Building on February’s +4% gain, March was quite good a month for the cryptos involved in the experiment. The Top Ten portfolio added another +12%, bringing the total gain from January 1st, 2019 to +16.6%. While the spreadsheet makes it look pretty even in terms of reds and greens, you’ll notice that the losses are all quite mild (ranging from -1% to -3%), while the gains are fairly significant (ranging from +4% to +31%).

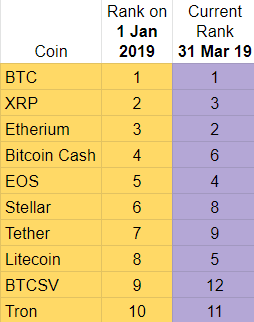

Ranking

Not much movement this month, and all of it downward. Tether and Tron both slipped two places to #9 and #11, respectively, and BTCSV dropped one from #11 to #12. Tron joins BTCSV as the second crypto to have already dropped out of the Top Ten. They have been replaced by Cardano and Binance Coin.

March Winners – Litecoin lead the pack in March, gaining +31%, followed closely by Bitcoin Cash and Stellar, up +28% and +27% for the month.

March Losers – BTCSV and Ripple performed the worst, but were only down -3% and -2%, respectively, for the month.

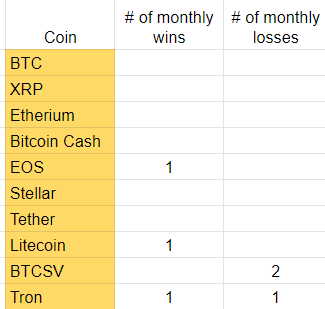

For those keeping score, here is tally of which coins have the most monthly wins and loses during the first 3 months of this experiment: EOS, Litecoin, and Tron each have one victory each. Bitcoin SV has lost two out of the first three months. Tron has recorded one monthly loss as well.

Overall update – Litecoin increases its lead, BTCSV down nearly 1/3rd.

So far, so good. Only three of the Top Ten have significantly lost value, the rest are at break even or in the green. Litecoin is having a great start to 2019, up nearly +100% on the year. EOS is in second place as of the end of March, up +61%. That initial $100 investment in Litecoin is now worth $200 bucks.

Bitcoin SV has lost about a third of its value since January 1st, 2019, down -31%. The initial $100 investment is now worth about $70.

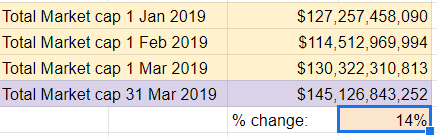

Total Market Cap for the entire cryptocurrency sector:

The market gained $15B and was up +11% in the last month and up +14% on the year. The end of March saw the highest total market cap so far for 2019.

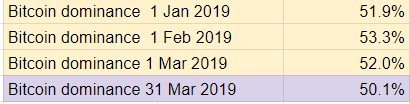

Bitcoin dominance:

Bitcoin dominance dropped again in March, inching closer to the psychologically significant 50% mark. If experiment history is any indication, we can expect to see BTC dominance drop as/if the overall market gains strength and people feel more willing to risk investing in projects other than Bitcoin.

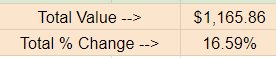

Overall return on investment from January 1st, 2019:

If I cashed out today, my $1,000 initial investment would return $1165, a 16% gain. This is a better return than the stock market (as measured by the S&P 500, see below).

Implications/Observations:

Another first for my series of experiments: March 2019 marked the first time I’ve been able to record back to back winning months since I started these Top Ten Crypto Index Fund style experiments.

Another difference from last year’s Top Ten: for the third month in a row, the 2019 Top Ten Experiment’s focus of solely holding the Top Ten was a winning strategy. Specifically, the 2019 Top Ten have so far returned +2% more than the entire market. This is a stark departure from last year: at no point in the Top Ten 2018 Experiment did this investment strategy work. The initial 2018 Top Ten under-performed every single month compared to the market overall last year.

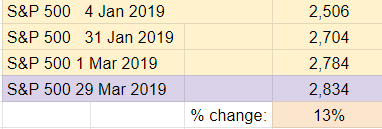

I’m also tracking the S&P 500 as part of my experiment to have a comparison point with other popular investments options. After a pretty significant December dip, the stock market rebounded nicely in 2019. Had I redirected my $1000 investment to the S&P 500, I would have been up about +$130, compared to the +$165 I’m currently ahead in crypto.

Conclusion:

For the first time in 15 months of reporting, I’ve been able to report two consecutive positive months. Two months don’t make a pattern, but it is a positive sign. I look forward to seeing if the early April gains hold through the entire month.

If you’re just finding this experiment now, here’s the backstory: On the 1st of January, 2018, I bought $100 each of the Top Ten cryptos at the time for a total investment of $1000 to see how they would perform over the year. I tracked the experiment and reported each month. The result? I ended 2018 down -85%, my $1000 worth only $150.

After last year’s experiment ended, I decided to do two things:

- Extend the Top Ten 2018 Crypto project one more year. The experiment is now in its 15th month. You can check out the latest update here.

- What you’re reading now is the 3rd report of a parallel project: on January 1st, 2019, I repeated the experiment, purchasing another $1000 ($100 each) into the new Top Ten cryptos as of January 1st, 2019.

Thanks for reading and the support for the experiment. I hope you’ve found it helpful. I continue to be committed to seeing this process through and reporting along the way. Feel free to reach out with any questions and stay tuned for progress reports.

This article contains affiliate links. If you click on a link in this article, I may earn a small commission at no extra cost to you.

Help keep the lights on at the Top Ten Crypto Index Fund Experiments.

Donate directly:

Bitcoin: bc1qqy4tlwydyrm3sjpyyq88es0cu9j9mdvqer3gwv

Ethereum: 0xC04Bc1996320f27c0A6018cB370c9469a9Dd3a4C

ADA: addr1qywnu55t8hpk4c3jf63tj5xywzej0uhwh7yput4u2z3fq7qa8efgk0wrdt3ryn4zh9gvgu9nylewa0ugrchtc59zjpuqlj6stg

XLM: GA5GJ2JDWC3GB3YXEVRBSR7UBLIB2ROIWZ5FEHML5WXGY5N3PAIDEOEA