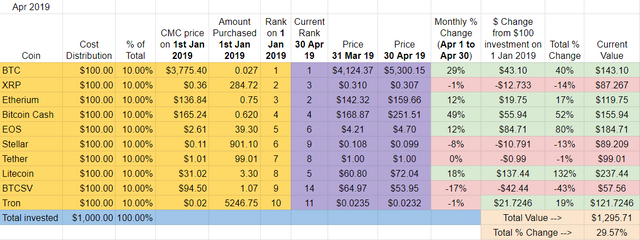

Month Four – Up 30%

April was another solid month for the 2019 Experiment. The Top Ten portfolio added another +14%, bringing the total gain from January 1st, 2019 to +30%. Like March, While the spreadsheet makes it look pretty even in terms of reds and greens, you’ll notice that the losses are all quite mild (except for BTCSV, which had a horrible month) and the gains are exceptional, ranging from +12% to +49%).

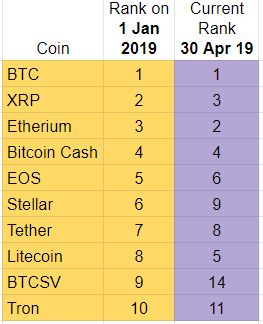

Ranking

Half of the Top Ten were on the move in April. Tether climbed one spot from #9 to #8, Bitcoin Cash leaped two spots from #6 to #4. Moving downward, EOS switched with Bitcoin Cash, falling from #4 to #6. Stellar slipped one place from #8 to #9 and BTCSV fell another 2 slots from #12 to #14.

Tron and BTCSV have already dropped out of the Top Ten. They have been replaced by Cardano and Binance Coin.

April Winners – Bitcoin Cash crushed the competition in April, up almost +50% in the month. Building on a gain of +28% in March, Bitcoin Cashseems to have built a bit of momentum. A distant second in April is Bitcoin, up almost +30%.

April Losers – BTCSV again had a rough month, down -17%, followed by Stellar, down -8%.

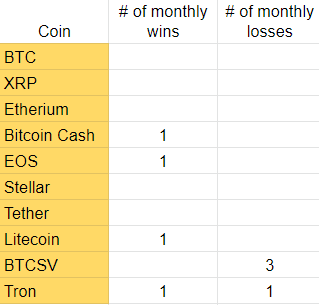

For those keeping score, here is tally of which coins have the most monthly wins and loses during the first 3 months of this experiment: Bitcoin Cash, EOS, Litecoin, and Tron each have one victory each. Bitcoin SV has now lost three out of the first four months. Ouch. Tron has recorded one monthly loss as well.

Overall update – Litecoin increases its lead again, BTCSV down -43%

Only three of the Top Ten have significantly lost value, the rest are at break even or in the green. Litecoin continues to increase its lead, now up nearly +132% on the year and has pulled even further ahead of second place EOS. For EOS, being in second place means “only” being up +80%. Not bad. My initial $100 investment in Litecoin is now worth $237.

Bitcoin SV, on the other hand, continues its downward trajectory, now down -43% since January 1st, 2019. The initial $100 investment in BTCSV is now worth about $58.

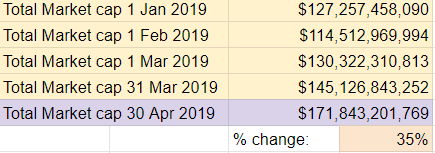

Total Market Cap for the entire cryptocurrency sector:

The total crypto market cap increased over $25B in April, up +18% from last month’s report. The end of April saw the highest total market cap so far for 2019 and is now up +35% since the beginning of 2019.

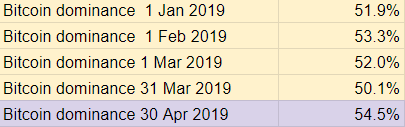

Bitcoin dominance:

After dropping in March, Bitcoin dominance moved up again in April, now approaching 55%.

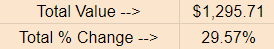

Overall return on investment from January 1st, 2019:

If I cashed out today, my $1,000 initial investment would return $1296, a +30% gain. This is nearly double the return the stock market has provided (as measured by the S&P 500, see below).

Implications/Observations:

April 2019 marked the first time I’ve been able to record three back to back winning months since I started these Top Ten Crypto Index Fund style experiments.

A significant change this month: up until March, the 2019 Top Ten Experiment’s focus of solely holding the Top Ten was a winning strategy. This was a stark departure from last year because at no point in the Top Ten 2018 Experiment did this investment strategy work.

Well, that changed in April. The 2019 Top Ten strategy yielded a +30% gain, while the overall crypto market gained +35%. This is largely because of the meteoric fall of BTCSV.

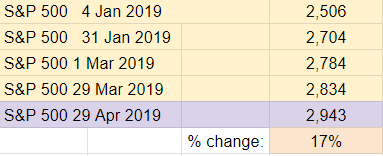

I’m also tracking the S&P 500 as part of my experiment to have a comparison point with other popular investments options. After a pretty significant December dip, the stock market has rebounded nicely in 2019. Had I redirected my $1000 investment to the S&P 500, I would be up about +$170, compared to the +$296 I’m currently ahead in crypto.

Conclusion:

For the first time in 16 months of reporting, I’ve been able to report three consecutive positive months. That’s not definite proof that we’re out of the bear market, but it’s not nothing either. The next few months will show us if this is a temporary peak or the start of a true bull run.

If you’re just finding this experiment now, here’s the backstory: On the 1st of January, 2018, I bought $100 each of the Top Ten cryptos at the time for a total investment of $1000 to see how they would perform over the year. I tracked the experiment and reported each month. The result? I ended 2018 down -85%, my $1000 worth only $150.

After last year’s experiment ended, I decided to do two things:

- Extend the Top Ten 2018 Crypto project one more year. The experiment is now in its 16th month. You can check out the latest update here.

- What you’re reading now is the 4th report of a parallel project: this year I repeated the experiment, purchasing another $1000 ($100 each) of the new Top Ten cryptos as of January 1st, 2019.

Thanks for reading and the support for the experiment. I hope you’ve found it helpful. I continue to be committed to seeing this process through and reporting along the way. Feel free to reach out with any questions and stay tuned for progress reports.

This article contains affiliate links. If you click on a link in this article, I may earn a small commission at no extra cost to you.

Help keep the lights on at the Top Ten Crypto Index Fund Experiments.

Donate directly:

Bitcoin: bc1qqy4tlwydyrm3sjpyyq88es0cu9j9mdvqer3gwv

Ethereum: 0xC04Bc1996320f27c0A6018cB370c9469a9Dd3a4C

ADA: addr1qywnu55t8hpk4c3jf63tj5xywzej0uhwh7yput4u2z3fq7qa8efgk0wrdt3ryn4zh9gvgu9nylewa0ugrchtc59zjpuqlj6stg

XLM: GA5GJ2JDWC3GB3YXEVRBSR7UBLIB2ROIWZ5FEHML5WXGY5N3PAIDEOEA