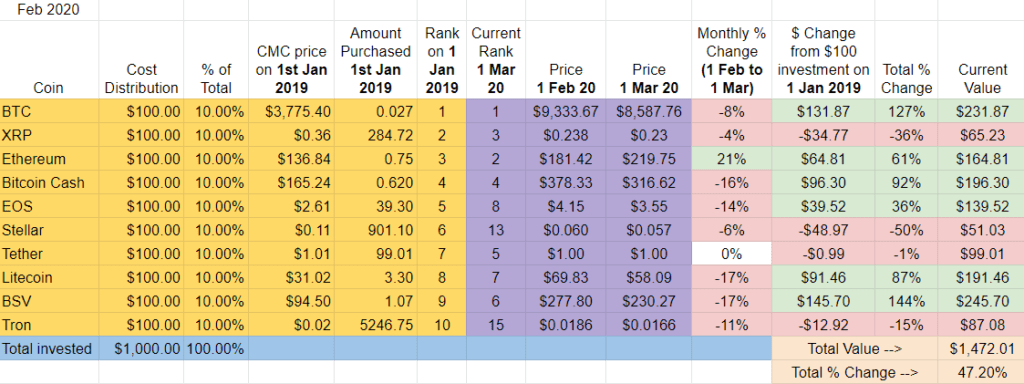

Month Fourteen – UP 47%

After a January which saw green across the board, the 2019 Top Ten cooled off significantly. With the exception of ETH, the entire group finished down in February.

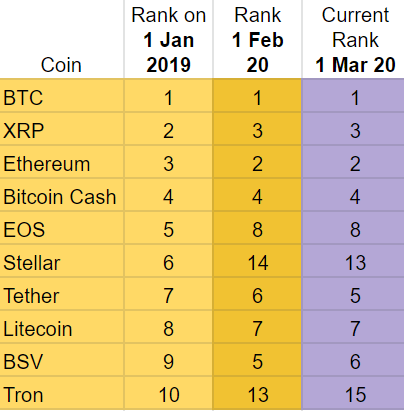

Ranking and February Winners and Losers

Two up, two down this month. Both Stellar and Tether climbed one spot and BSV and Tron both fell in February – one spot to #6 for BSV and two spots to #15 for Tron.

Stellar and Tron remain the only two cryptos to have dropped out of the 2019 Top Ten. They have been replaced by Binance Coin and Cardano. If we compare to the 2018 Top Ten Experiment, four cryptos had already dropped out by the 14 month mark.

February Winners – Ethereum alone finished in positive territory, ending the month up an impressive +21%.

February Losers – BSV and Litecoin finished the month in a virtual tie, both down -17%. But since it also lost one place in the rankings, I’ll go ahead and give BSV the loss. Close behind was Bitcoin Cash, down -16% in February.

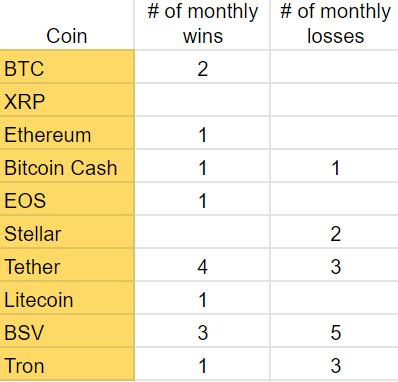

For those keeping score, here is tally of which coins have the most monthly wins and loses during the first fourteen months of the 2019 Top Ten Experiment: Tether is still in the lead followed by BSV in second place. BSV also holds the most monthly losses, finishing last in five out of fourteen months.

Overall update – BSV in overall lead. Stellar worst performer, down -50%.

BSV lost a bit of ground to Bitcoin this month, but still is holding on to the lead it opened up in January. It is up +144% since January 2019 compared to second place BTC, up +127%. Bitcoin Cash follows in third place, up +92%. My initial $100 investment in BSV is now worth $246.

While 40% of the 2019 Top Ten Cryptos were up over the +100% mark last month, this month it’s only BSV and Bitcoin. Still, seven out of the ten cryptos in this group have either broke even or are solidly in the green.

Stellar remains firmly at the bottom, down -50% after the first 14 months. XRP is the second worst performer, down -36%.

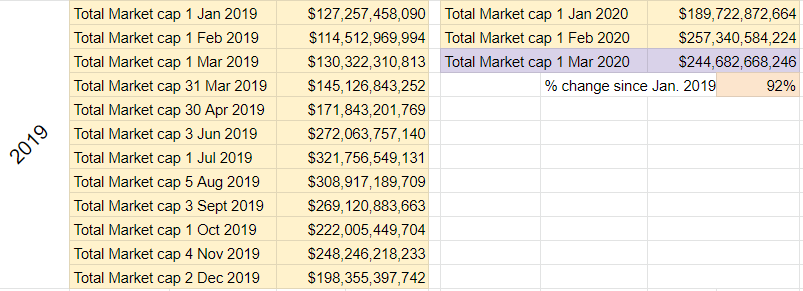

Total Market Cap for the entire cryptocurrency sector:

Not that bad of a month, at least not for those who have been following crypto for a while. The market did lose about $12B in February, but overall the crypto market is up +92% since the 2019 Top Ten Experiment began in January 2019.

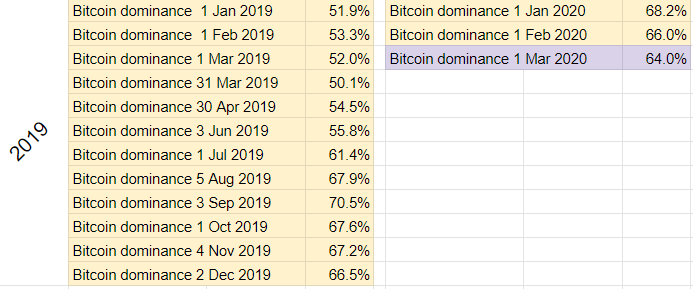

Bitcoin dominance:

Bitcoin dominance dipped a few more percentage points in February, finishing the month at 64%. The last time BTC dominance was this low was in July 2019. The range since the beginning of the experiment in January 2019 has been between 50%-70%.

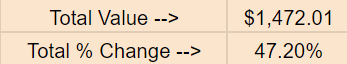

Overall return on investment since January 1st, 2019:

The 2019 Top Ten Portfolio lost about $160 in February. After the initial $1000 investment, the 2019 Top Ten Portfolio is worth $1,472, up about +47%.

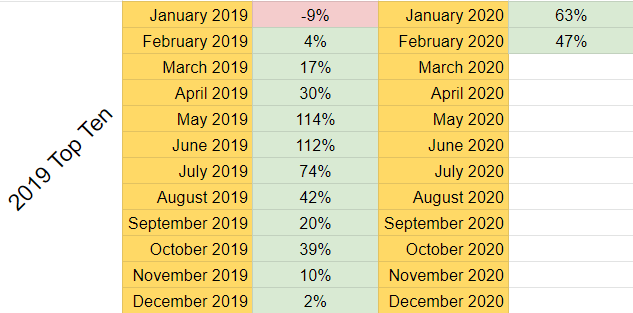

Here’s a look at the ROI over the life of the first fourteen months of the experiment, month by month:

As you can see, every month except the first month (January 2019) is green. At the lowest point, the 2019 Top Ten portfolio was down -9%, at the highest point, up +114% (May 2019).

How does the 2019 Top Ten Experiment compare to the parallel projects?

- 2018 Top Ten Experiment: down 81% ($186)

- 2020 Top Ten Experiment: up about +51% ($1,512)

Taken together, here’s the bottom bottom bottom line:

After a $3000 investment in the 2018, 2019, and 2020 Top Ten Cryptocurrencies, my portfolios are worth $3,170.

That’s up about +5.6%.

Implications/Observations:

While the crypto market as a whole is up +92% since January 2019, the 2019 Top Ten cryptos have gained just +47%.

This is reminiscent of the 2018 group as at no point in the first twenty-six months of the Top Ten 2018 Experiment has the approach of focusing on the Top Ten cryptos outperformed the overall market. There are a few examples, however, of this approach outperforming the market in the 2019 Top Ten Crypto Experiment. And the first couple of 2020 Experiment updates show that focusing on the Top Ten is a winning strategy, at least in the first two months of 2020.

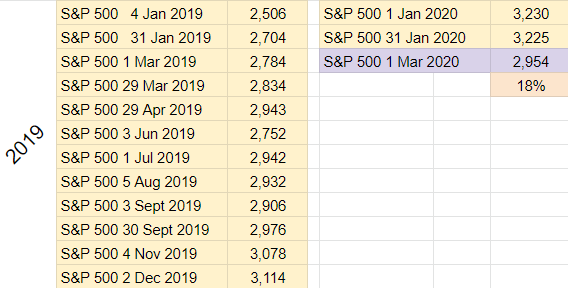

I’m also tracking the S&P 500 as part of my experiment to have a comparison point with other popular investments options. The S&P 500 took a coronavirus beating in February, but is still up +18% since the January 2019. The 2019 Top Ten portfolio is returning +47% over the same time period.

So, the initial $1k investment I put into crypto would now be worth $1180 had it been redirected to the S&P 500 in January 2019.

But what if I took the same world’s-slowest-dollar-cost-averaging/$1,000-per-year-in-January approach with the S&P 500? It would yield the following:

- $1000 investment in S&P 500 on January 1st, 2018: +$110

- $1000 investment in S&P 500 on January 1st, 2019: +$180

- $1000 investment in S&P 500 on January 1st, 2020: -$90

Taken together, here’s the bottom bottom bottom line for the S&P:

After three $1,000 investments into an S&P 500 index fund in January 2018, 2019, and 2020, my portfolio would be worth $3,200.

That’s up about +6.7% compared to +5.6% with the Top Ten Crypto Experiments, the narrowest gap since I started the updates in January 2018.

Conclusion:

While Coronavirus is tanking world markets, crypto followers shrug – we’re used to seeing this kind of movement. I guess one of the perks of following such a volatile asset class?

Thanks for reading and for supporting the experiment. I hope you’ve found it helpful. I continue to be committed to seeing this process through and reporting along the way. Feel free to reach out with any questions and stay tuned for progress reports. Keep an eye out for the original 2018 Top Ten Crypto Index Fund Experiment and the recently launched 2020 Top Ten Experiment.

This article contains affiliate links. If you click on a link in this article, I may earn a small commission at no extra cost to you.

Help keep the lights on at the Top Ten Crypto Index Fund Experiments.

Donate directly:

Bitcoin: bc1qqy4tlwydyrm3sjpyyq88es0cu9j9mdvqer3gwv

Ethereum: 0xC04Bc1996320f27c0A6018cB370c9469a9Dd3a4C

ADA: addr1qywnu55t8hpk4c3jf63tj5xywzej0uhwh7yput4u2z3fq7qa8efgk0wrdt3ryn4zh9gvgu9nylewa0ugrchtc59zjpuqlj6stg

XLM: GA5GJ2JDWC3GB3YXEVRBSR7UBLIB2ROIWZ5FEHML5WXGY5N3PAIDEOEA

Pingback: $1,000 invested in Top 10 Cryptos of 2019 now worth $1,260 (UP +26%) - Crypto: News, Games and more stuff

Pingback: I bought $1000 worth of the Top Ten Cryptos on January 1st, 2019 (Feb 2020 Update) – Nakamoto News

Pingback: I bought $1000 worth of the Top Ten Cryptos on January 1st, 2019 (Feb 2020 Update) | News