Month Fourteen – Down 86%

Well, here’s something we haven’t seen too often. A month to month sea of green! In fact, this is only the second time in the life of this experiment that we’ve seen each of the Top Ten finish in positive territory at the end of the month. The last time was in April 2018.

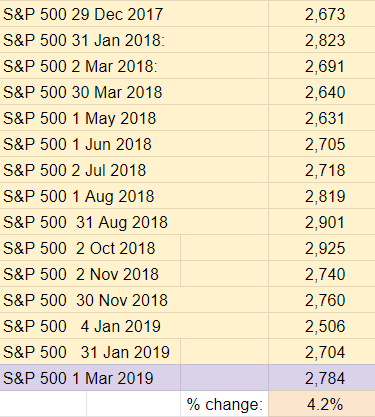

The crypto market as a whole is up 14% in February. Not at all a bad showing, especially considering the stock market (as measured by the S & P 500) is only up about 3%.

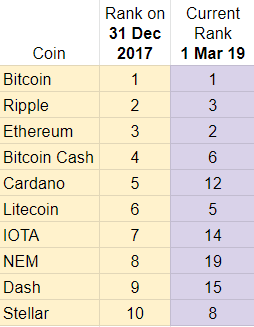

Ranking

Lots of movement again this month. Ripple and Ethereum switched places again now occupying slots #3 and #2, respectively. As it did last month, Bitcoin Cash dropped a spot to 6th place and now has been overtaken by EOS and Litecoin. Speaking of Litecoin, it had the best positive movement, rising two places from 7th to 5th. Cardano slipped from 11th place to 12th place and NEM dropped from 18th place to 19th place and leads the race to the bottom – looks like it might be the first to drop out of the Top Twenty. XLM stopped its two month skid, inching up a notch from 9th to 8th place.

NEM, Cardano, Dash, and IOTA are Top Ten dropouts – they have been replaced by EOS, Tether, Binance Coin, and Tron.

February Winners – For the second month in a row the winner is Litecoin, easily, up 42% this month and advancing two places in the rankings. Ethereum and Dash had good months as well, both up about 25%.

February Losers – Each of the Top Ten finished in the green this month, but Stellar only gained 1% making it the worst performer in February.

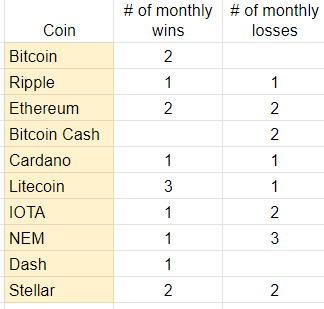

For those keeping score, here is tally of which coins have the most monthly wins and loses during the first 14 months of this experiment. Most monthly wins (3): Litecoin. Most monthly loses (3): NEM.

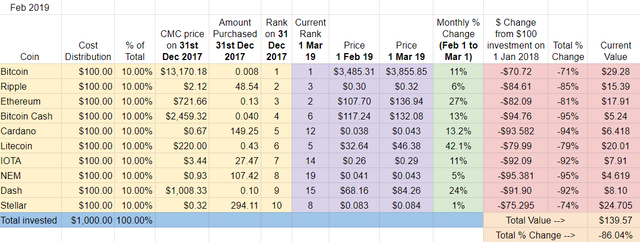

Overall update – Bitcoin reclaims lead from Stellar. NEM and BCH at the bottom.

Bitcoin broke the tie this month, moving past Stellar for the overall lead. For context “being in the lead” in this experiment means Bitcoin is down -71% and Stellar in second place is down -74%. This is since the start of this experiment, the 1st of January 2018.

NEM and Bitcoin Cash are virtually tied at the bottom, down 95% each. My initial $100 investment in NEM is worth just $4.61 and Bitcoin Cash is worth just $5.24.

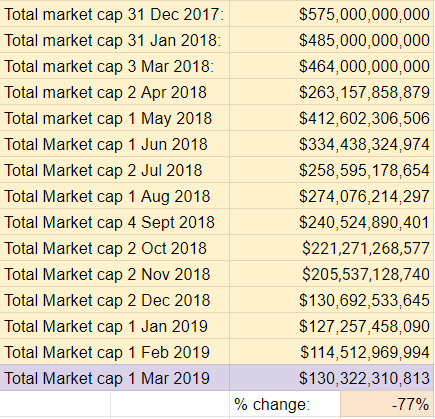

Total Market Cap for the entire cryptocurrency sector:

We saw a +3% rebound this month. The value of the market gained $16B in February. It is down -77% since the beginning of the experiment, January 1st, 2018, but with the market cap hovering around the $130B mark, crypto has clawed its way back up to late November/early December 2018 levels.

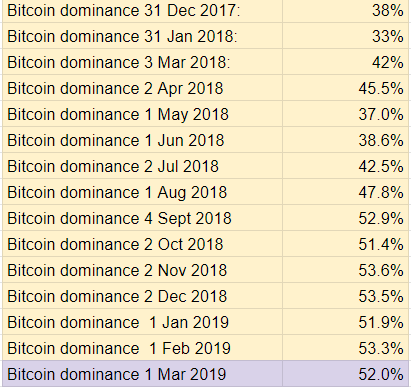

Bitcoin dominance:

Bitcoin dominance dropped a bit, but still basically in the range it has remained in since September 2018. If experiment history is any indication, we can expect to see BTC dominance to drop as/if the overall market gains strength.

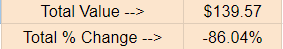

Overall return on investment from January 1st, 2018:

My Top Ten of 2018 portfolio increased nearly $20 in total value this month. A tiny gain, but noteworthy, as ending a month in positive territory is rare thus far in the experiment. If I cashed out today, my $1000 initial investment would return about $140, down -86%. Another rare event: I have almost always ended the month setting a record low in terms of value over the life of the experiment. This month that is not the case.

Implications/Observations:

As I mentioned earlier, a 100% green month is very rare and has only happened one other time (April 2018) out of fourteen months.

Stellar, 2018’s champion, stabilized, but was overtaken by Bitcoin which has reclaimed the lead.

The experiment’s focus of solely holding the Top Ten continues to be a losing proposition. While the overall market is down -77% from January 2018, the cryptos that began 2018 in the Top Ten are down -86% over the same period of time. At no point in the experiment has this investment strategy worked: the initial 2018 Top Ten continue to under-perform compared to the market overall.

The 9% difference is slightly up from last month. The widest gap was a 12% difference at one point last year (September 2018).

I’m also tracking the S&P 500 as part of my experiment to have a comparison point with other popular investments options. After a pretty significant December dip, the stock market continues to rebound. It’s up 4.2% since the beginning of 2018, so that $1k investment I threw into crypto would have yielded +$42.

Conclusion:

February was a solid month for crypto and a rare all green month for our Top Ten cryptos. With the market back up to late November 2018 levels, is crypto finally on its way back up?

Thanks for reading and the support for the experiment. I hope you’ve found it helpful. I continue to be committed to seeing this process through and reporting along the way. Feel free to reach out with any questions and stay tuned for progress reports.

This article contains affiliate links. If you click on a link in this article, I may earn a small commission at no extra cost to you.

Help keep the lights on at the Top Ten Crypto Index Fund Experiments.

Donate directly:

Bitcoin: bc1qqy4tlwydyrm3sjpyyq88es0cu9j9mdvqer3gwv

Ethereum: 0xC04Bc1996320f27c0A6018cB370c9469a9Dd3a4C

ADA: addr1qywnu55t8hpk4c3jf63tj5xywzej0uhwh7yput4u2z3fq7qa8efgk0wrdt3ryn4zh9gvgu9nylewa0ugrchtc59zjpuqlj6stg

XLM: GA5GJ2JDWC3GB3YXEVRBSR7UBLIB2ROIWZ5FEHML5WXGY5N3PAIDEOEA