Month/Episode Seven – The Force Awakens…But Not Really, Still Down 63%

There’s been an awakening – have you felt it?

Well, maybe not a full on awakening, but we’re finally seeing a bit of upward movement. I always enjoy the these updates, but have to admit it’s a bit more fun to share when there’s at least some green on the board.

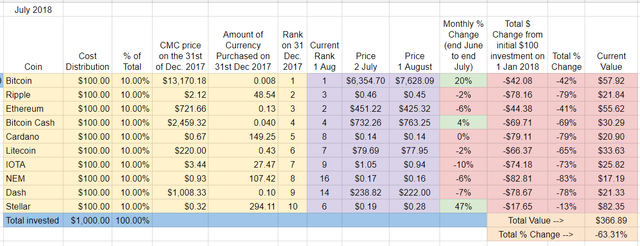

July Winners – Stellar, Stellar, Stellar! What a great month for the Little Crypto Who Could. After falling 37% in June, Stellar has regained last month’s loses and then some, posting a 47% gain in the last thirty days. It has also moved up two positions in July from #8 to #6. Bitcoin finishes second this month with an impressive 20% gain, and Bitcoin Cash added 4% landing it in third place.

July Losers – IOTA performed the worst this month, down 10%. It wouldn’t be so bad had IOTA not got hammered in June as well (it was down -44% last month). All others either broke even or lost less than 10%. Not bad considering the year we’ve been having so far.

Overall update – Stellar back in the lead with a vengance. NEM at the bottom as usual

Stellar is the only crypto approaching the break even point, down 13% on the year and looks to be within striking distance of the price it held on the 1st of January 2018. It is the best performing of the original 2018 Top Ten by far. It’s not even close.

A distant second is Ethereum and Bitcoin both down over -40% since the begining of the year.

NEM still holds its familiar position at the bottom: it has the dubious distinction of worst performer this year, down -83%. That means my initial $100 investment is now worth about $17 bucks.

Ripple, Cardano, and DASH aren’t doing much better, each down around 78% on the year.

In terms of movement, Stellar again made the most progress this year, moving up four slots from #10 to #6 since January 1st, 2018. Sixth place is back where it sat the end of January. The award for biggest drop goes to NEM who dropped from #8 at the beginning of the year to #16 today.

Only NEM and Dash have fallen out of the Top Ten. They have been replaced by EOS (now at #5) and Tether (currently at #10).

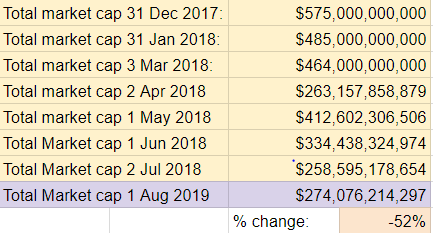

Total Market Cap for the entire cryptocurrency sector:

July saw the total market cap gain approximately $15B. Definitely positive news, but for a bit of perspective: from January 1st the market has lost -52% or just over $300 billion in value.

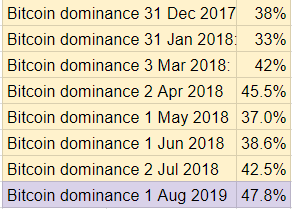

Bitcoin dominance:

Bitcoin dominance increased to a high for the year of nearly 48% this month, up about 3% from the previous high in March.

Overall return on investment since January 1st, 2018:

My $1000 initial investment is now worth about $367, down -63%. Not the lowest I’ve been this year, but close. I’m back to where I was at the end of March, up a little from the end of June.

Implications/Observations:

Although the last week or so has seen a downturn, the crypto space did fairly well in July and fared much better than it did in June. Bitcoin crossed the $8k level and while it’s come back down to the $7,500 range, at the end of June it was closer to $6,300.

This month, Stellar really put some space between itself and the rest of the field. This is unsurprising at this point – without exception throughout the experiment, every single month has been won by either Stellar or Ethereum. Although Stellar has significantly widened the gap this month – it’s down -13% on the year while Ethereum and Bitcoin are down -40%.

Again, the approach on holding equal amouts of only the Top Ten continues to be a losing strategy. While the overall market is down -52% from January, the cryptos that began 2018 in the Top Ten are down -63% over the same period of time. This approximately 11% differential is about the same as last month, but that gap has generally continued to increase as the year goes along.

At no point in the experiment has this investment strategy worked: the initial Top Ten continue to underperform compared to the market overall. In months like July where Bitcoin has done well, I’m curious how it would have turned out if I had tried to weight the Top Ten like a proper Index Fund. Maybe I’ll run the numbers and share the results.

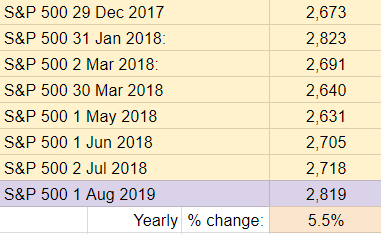

I’m also tracking the S&P 500 as part of my experiment to have a comparison point with other popular investments options. As of August 1st, it’s up 5.5% for the year.

Not bad.

Conclusion:

July saw some positive price movement in the crypto space. In terms of overall market cap, it’s recovered nicely from the June lows and now sits higher than March as well. July saw some days where the market cap got back over the $300 billion mark. Let’s see if we can have more of those days as we progress through the summer.

Thanks for reading and the support for the experiment. I hope you’ve found it helpful. I continue to be committed to seeing this process through and reporting along the way. Feel free to reach out with any questions and stay tuned for progress reports.

What do you think about the way the market is going this year? Do you think crypto bottomed out in June?

This article contains affiliate links. If you click on a link in this article, I may earn a small commission at no extra cost to you.

Help keep the lights on at the Top Ten Crypto Index Fund Experiments.

Donate directly:

Bitcoin: bc1qqy4tlwydyrm3sjpyyq88es0cu9j9mdvqer3gwv

Ethereum: 0xC04Bc1996320f27c0A6018cB370c9469a9Dd3a4C

ADA: addr1qywnu55t8hpk4c3jf63tj5xywzej0uhwh7yput4u2z3fq7qa8efgk0wrdt3ryn4zh9gvgu9nylewa0ugrchtc59zjpuqlj6stg

XLM: GA5GJ2JDWC3GB3YXEVRBSR7UBLIB2ROIWZ5FEHML5WXGY5N3PAIDEOEA

Pingback: seo guide reddit