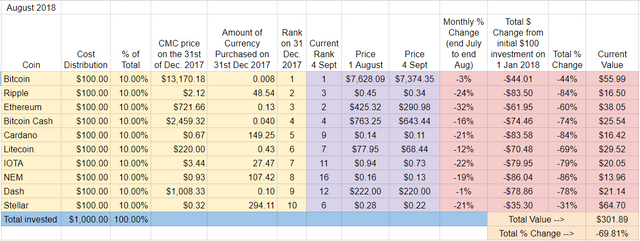

Month/Episode Eight – Down 70%

Remember the hope you felt at the end of July? That we’d finally hit bottom in crypto markets and things were looking up – the only direction to look if you’re at the bottom, right?

Yeah, not so much.

Although the last few days have seen some positive movement, let me depress you by sharing some actual numbers.

August Winners – Dash pulled out a victory this month (its first of the experiment) down just -1%, basically breaking even. Bitcoin finished a close second, down about -3%. Dash was also the only crypto in the Top Ten that advanced in ranking, moving up two slots from 14 to 12.

August Losers – Ethereum had a rough August, shedding almost a third of its value, down -32%. Ripple performed poorly this month as well, down -24%

Overall update – Stellar holds the lead followed by BTC. NEM in a familiar position

Although Stellar lost a lot of ground (-21%) this month it remains in the lead, down -31% for the year. Bitcoin is a distant second, down -44% for the year.

NEM still holds its familiar position at the bottom down -86% since January 1st. So my initial $100 investment in NEM at the beginning of the year is now worth about $14 bucks. Ripple and Cardano are closely behind: both are down -84% since the year started.

In terms of ranking, this month IOTA disappeared from the Top Ten, falling from 9th position to #11. IOTA joins NEM and Dash as Top Ten dropouts. They have been replaced by EOS (now at #5), Tether (currently at #8), and Monero (currently at #10).

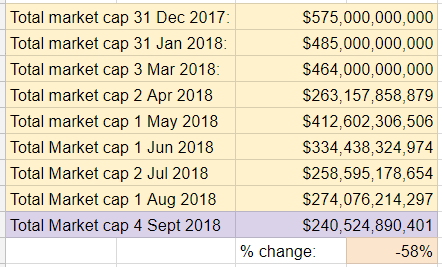

Total Market Cap for the entire cryptocurrency sector:

August saw the value of the crypto space as a whole continue to slide. The total market cap for crypto is now at its lowest month-end point of the year. From January 1st the market has lost -58%. Crypto hasn’t ended a month above $300B since the end of May.

Bitcoin dominance:

We’ve got a new high for the year in Bitcoin dominance – it’s at 53%. We’ve seen this throughout the experiment – predictably, when the overall market dives, BTC‘s dominance takes off. It unsurprising that the end of August saw the yearly low in overall market cap coincide with the yearly high in BTC dominance.

Overall return on investment from January 1st, 2018:

If I cashed out today, my $1000 initial investment would return $302, down -70%. Although March and June were bad, August is now officially the lowest point in the experiment in terms of overall value.

Implications/Observations:

Yet another rough month in cryptolandia. The end of August/beginning of September has seen a bit of a bounce in prices, but the overall market cap is at yearly lows. It’s a good sign that Bitcoin is back above $7k, but many of the altcoins are running up against their lows for the year.

We saw a bit of a shake up this month with Dash and Bitcoin finishing in the first and second positions. Before August (without exception) either Stellar or Ethereum outperformed their Top Ten peers in the monthly recaps. That said, Stellar continued the habit of placing at or near the top of the original Top Ten pack overall for the year.

Once again, focusing solely on holding the Top Ten continues to be a losing strategy. While the overall market is down -58% from January, the cryptos that began 2018 in the Top Ten are down -70% over the same period of time. This approximately 12% differential continues to widen as the year progresses. At no point in the experiment has this investment strategy worked: the initial Top Ten continue to underperform compared to the market overall.

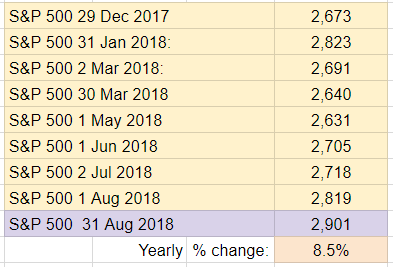

I’m also tracking the S&P 500 as part of my experiment to have a comparison point with other popular investments options. August was a good month for the index – it’s now up 8.5% for the year. A $1k investment would have given me $85, much better than the alternative – being down $700 on a $1k investment in crypto!

Conclusion:

Another painful month. This again feels like it has to be the bottom, right? But I’m going to stop guessing, because I keep getting it wrong. It would be nice though to report some gains for the experiment for a change!

Thanks for reading and the support for the experiment. I hope you’ve found it helpful. I continue to be committed to seeing this process through and reporting along the way. Feel free to reach out with any questions and stay tuned for progress reports.

What do you think about the way the market is going this year and when (if ever) do you think we’ll see a proper bull rally? Have we hit bottom yet?

This article contains affiliate links. If you click on a link in this article, I may earn a small commission at no extra cost to you.

Help keep the lights on at the Top Ten Crypto Index Fund Experiments.

Donate directly:

Bitcoin: bc1qqy4tlwydyrm3sjpyyq88es0cu9j9mdvqer3gwv

Ethereum: 0xC04Bc1996320f27c0A6018cB370c9469a9Dd3a4C

ADA: addr1qywnu55t8hpk4c3jf63tj5xywzej0uhwh7yput4u2z3fq7qa8efgk0wrdt3ryn4zh9gvgu9nylewa0ugrchtc59zjpuqlj6stg

XLM: GA5GJ2JDWC3GB3YXEVRBSR7UBLIB2ROIWZ5FEHML5WXGY5N3PAIDEOEA