This article contains affiliate links. If you click on a link in this article, I may earn a small commission at no extra cost to you.

Recommended Storage:

For crypto storage, my recommended hardware wallet is the Ledger Nano X.

Recommended Exchange:

On solid financial footing and ready to purchase crypto? My recommended exchange is Binance.

Get up to $59 of FREE COMP with Coinbase Earn

AND Get up to $50 of FREE XLM with Coinbase Earn

Considering getting into cryptocurrencies?

Be prepared for a wild ride.

In fact, I recommend getting your financial house in order first.

Month Thirty One – Down 74%

Crypto came roaring back in July after an almost all-red June. Each crypto in the 2018 Top Ten finished July at a significantly higher value, led by ADA which ended the month +57%.

Question of the month:

Which member of all three Top Ten Crypto Index Fund Experiments turned 5 years old in July?

A) Bitcoin

B) Ethereum

C) Bitcoin Cash

D) XRP

Scroll down for the answer.

Ranking and July Winners and Losers

Not a ton of movement for the 2018 Top Ten group this month. Cardano and XRP both climbed one position while NEM gained two, clawing itself back into the Top thirty. Dash headed in the other direction, dropping two places in the rankings.

Considering all that has changed in the world of crypto since the beginning of 2018, it’s interesting to note that only four out of the ten cryptos that started 2018 in the Top Ten have dropped out. NEM, Dash, IOTA, and Stellar have been replaced by Binance Coin, Tether, BSV, and newcomer CRO.

July Winners – It was a very strong month: all cryptos made significant gains in July. But for the third month in a row ADA outperformed the field, gaining +57% in July. ETH finished a close second, up +55% followed by XRP which gained +52%.

July Losers – Even during a good month, NEM can’t catch a break. Its +23% gain made it the worst performer of the 2018 Top Ten.

How has your favorite crypto fared over the first 31 months of the 2018 Top Ten Crypto Index Fund Experiment?

Bitcoin still has the most monthly wins (7) but look at this: thanks to its strong 2020 including three straight monthly wins, Cardano is now right behind BTC with 6 monthly wins. Which project has the most monthly losses? NEM stands alone with 6. Every crypto has at least one monthly win and Bitcoin is unique as the only cryptocurrency that hasn’t lost a month. It came close this month, gaining “only” +26%.

Overall update – BTC approaching break even point, second place ETH in the lonely middle, NEM still worst performing.

Although it wasn’t able to keep pace with its peers in July, BTC continues to slowly but surely approach its break even point. It is down about $1,500 (-12%) since my purchase in January 2018. My initial investment of $100 thirty-one months ago is now worth about $88.

Even though Ethereum has lost half of its value since the experiment began, it is all alone in second place: no other crypto is close.

NEM seems comfortable in its usual place, down at the bottom. It has lost -94% over the life of the experiment. That initial $100 investment in NEM is now worth $5.78. Dash and IOTA join NEM as the only three cryptos in the Top Ten that have lost at least -90% of their value since January 2018.

Total Market Cap for the entire cryptocurrency sector:

The crypto market added about $82B in July, making up a ton of ground. The last time we saw a similar level in terms of overall crypto market cap was way back in the fifth month of the 2018 Top Ten Experiment: May 2018.

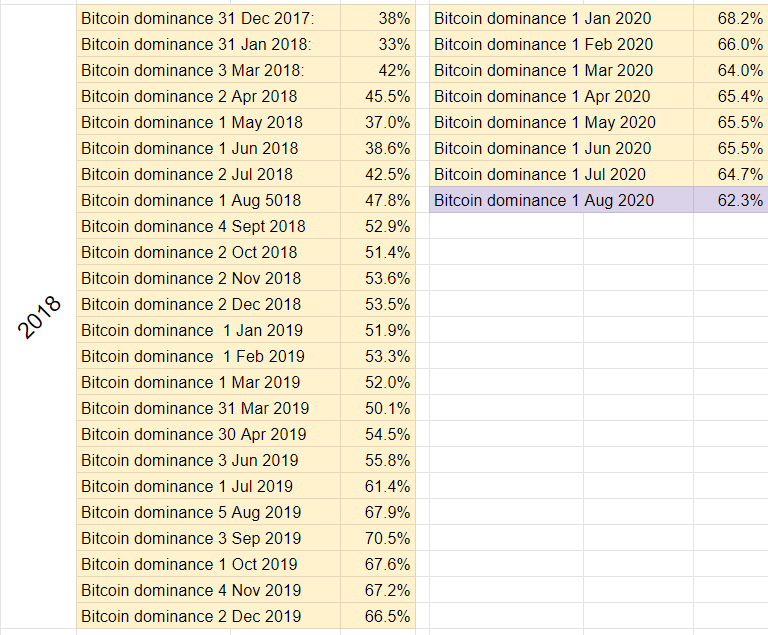

Bitcoin dominance:

Since Bitcoin receives much of the attention in the press, it may surprise the casual observer to learn that Bitcoin Dominance dropped quite a bit in July, especially considering BitDom had been stuck at roughly the same level for most of 2020. This signals an interest in altcoins and a willingness to buy into riskier cryptos.

Some context: since the beginning of the experiment, the range of Bitcoin dominance has been quite wide: we saw a high of 70% BitDom in September 2019 and a low of 33% BitDom in February 2018.

Overall return on investment since January 1st, 2018:

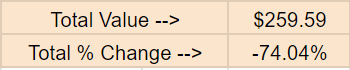

The 2018 Top Ten Portfolio gained over $70 in July 2020. If I cashed out today, my $1000 initial investment would return about $260, down -74% from January 2018.

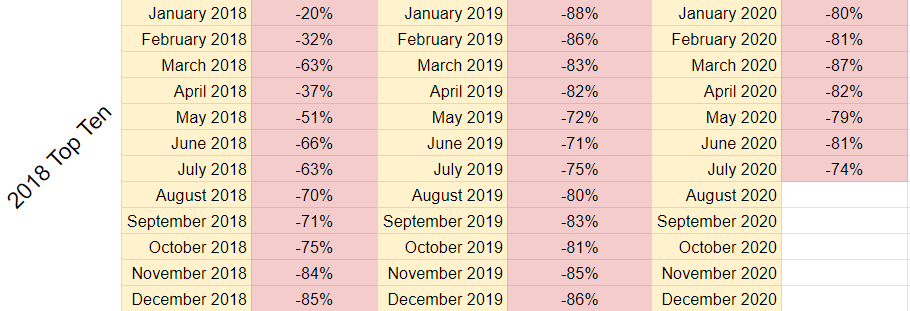

This sounds horrible but don’t hang yourself with a celibate rope: the 2018 return on investment is back where it was about a year ago. Take a look at the ROI over the life of the experiment, month by month, for some context:

Yes, you may notice that the 2018 Top Ten portfolio has finished over half of the first thirty one months down at least -80%, but it’s nice to see the low -70s for a change.

So the Top Ten Cryptos of 2018 are down -74%. What about the 2019 and 2020 Top Tens? Let’s take a look:

- 2019 Top Ten Experiment: up +72% ($1,722)

- 2020 Top Ten Experiment: up +71% ($1,713)

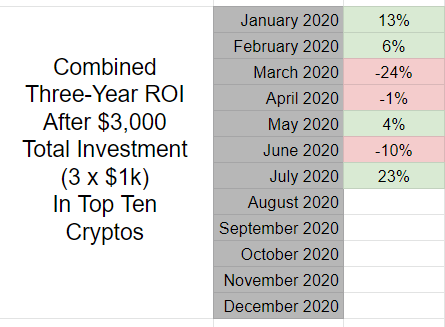

So overall? Taking the three portfolios together, here’s the bottom bottom bottom line:

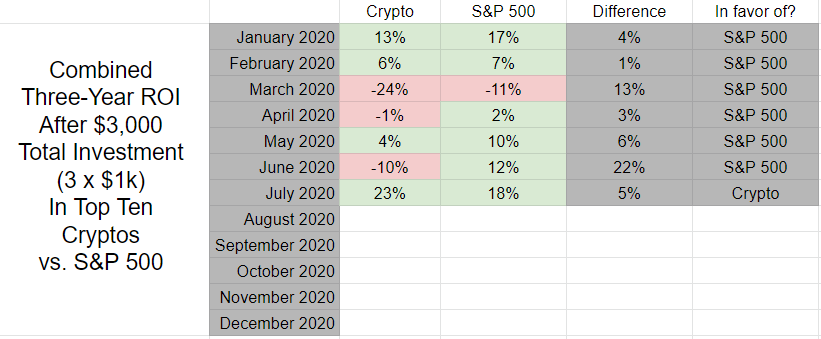

After a $3000 investment in the 2018, 2019, and 2020 Top Ten Cryptocurrencies, my combined portfolios are worth $3,695 ($260+ $1,722 +$1,713).

That’s up about +23% for the three combined portfolios, compared to -10% last month. It also marks the highest ROI of the three combined portfolios since I added this metric this year. The previous high was +13% back in January 2020.

Having trouble visualizing? Don’t worry, I got what you need:

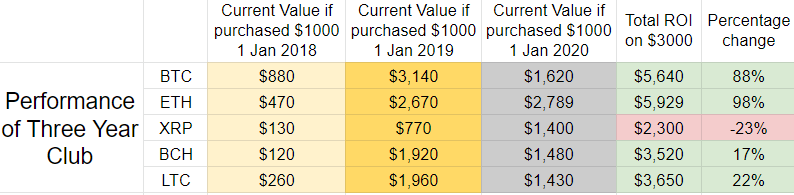

So, a +23% gain by dropping $1k on whichever cryptos were in the Top Ten on January 1st for three straight years, fine. But what if I’d done the same with just one crypto? Thanks to Reddit user u/sebikun for the idea for a new metric and let’s take a look:

As you can see, only five cryptos have remained in the Top Ten for all three years: BTC, ETH, XRP, BCH, and LTC. Best one to have gone all in on at this point in the Experiment? Ethereum, which would have nearly doubled. Worst choice? If I went with XRP, I would have been down -23%.

Comparison to S&P 500:

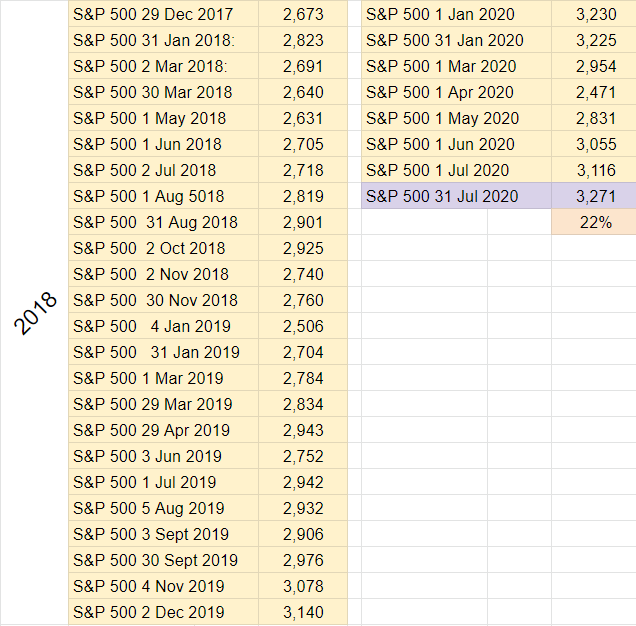

I’m also tracking the S&P 500 as part of the experiment to have a comparison point with other popular investments options. The US economy continued to recover in July: the S&P 500 is back up to pre-COVID levels. The initial $1k investment into crypto on January 1st, 2018 would have been worth about $1220 had it been redirected to the S&P.

But what if I took the same invest-$1,000-on-January-1st-of-each-year approach with the S&P 500 that I’ve been documenting through the Top Ten Crypto Experiments? Here are the numbers:

- $1000 investment in S&P 500 on January 1st, 2018: +$220

- $1000 investment in S&P 500 on January 1st, 2019: +$310

- $1000 investment in S&P 500 on January 1st, 2020: +$10

Taken together, here’s the bottom bottom bottom line for a similar approach with the S&P:

After three $1,000 investments into an S&P 500 index fund in January 2018, 2019, and 2020, my portfolio would be worth $3,540.

That is up over+18% since January 2018, compared to a +23% gain of the combined Top Ten Crypto Experiment Portfolios.

That’s a 5% swing in favor of the Top Ten Crypto Portfolios! As you’ll see in the table below, this is the first time since I started recording this metric that crypto has outperformed the S&P had I taken a similar investment approach. This is a big turnaround from the 22% difference in favor of the S&P just last month.

Implications/Observations:

The 2018 Top Ten Cryptos have consistently under-performed when compared to the overall crypto market. This month, for example, the total market cap is down -29% from January 2018 compared to the -74% loss for the cryptos that began 2018 in the Top Ten. At no point in the first 31 months of the Experiment has this investment strategy been successful: the 2018 Top Ten as a group have under-performed the overall market every single month.

This of course suggests that I would have done a bit better if I’d picked every crypto, or different cryptos: throwing that $1k on January 1st, 2018 to Bitcoin, for example, would have lost me -12% instead of -74%.

On the other hand, this bit of diversification has served me well compared to going all in on NEM, Dash, or IOTA, all of which are down at least -90%.

The follow-on Top Ten experiments in 2019 and 2020 have seen similar, but not identical, results. There have been a few examples of the Top Ten approach outperforming the overall market in the first 19 months of the parallel 2019 Top Ten Crypto Experiment. And up until the last few months of the most recent 2020 Top Ten Index Fund group of cryptocurrencies, this approach had outperformed the overall market 100% of the time.

Conclusion:

Crypto had an undoubtedly strong month in July, green across the board. Was this just a happy blip, are we in for some consolidation, or are we on the way up? Stay tuned.

Final words: take care of each other, wear your mask, wash your hands.

Thanks for reading and for supporting the experiment. I hope you’ve found it helpful. I continue to be committed to seeing this process through and reporting along the way. Feel free to reach out with any questions and stay tuned for progress reports. Keep an eye out for my parallel projects where I repeat the experiment twice, purchasing another $1000 ($100 each) of two new sets of Top Ten cryptos as of January 1st, 2019 then again on January 1st, 2020.

And the Answer is…

B) Ethereum

Ethereum celebrated its 5 year anniversary on July 30th, 2020.

Help keep the lights on at the Top Ten Crypto Index Fund Experiments.

Donate directly:

Bitcoin: 1Pwz1gABZd2jkfFrjSZbJmD3te3dFYjhJo

Ripple: rEVxyudxYfPDFiV9qVZU8m7v2w9vwc4UCj

Ethereum: 0xf1df4ae19e80dd195ac67281598d84C4D6df029f

Pingback: What if you bought/held $1k of the Top 10 Cryptos on Jan. 1st, 2019? (UP +72%) -

Pingback: I bought $1k of the Top Ten Cryptos on January 1st, 2018. Result? -74% | Crypto Basset Hound

Pingback: I bought $1k of the Top Ten Cryptos on January 1st, 2018. Result? -74% - Crypto: News, Games and more stuff

Pingback: I bought $1k of the Top Ten Cryptos on January 1st, 2018. Result? -74% : CryptoCurrency | https://cryptoyaks.com

Pingback: /u/Joe-M-4I bought $1k of the Top Ten Cryptos on January 1st, 2018. Result? -74%top scoring links : CryptoCurrency – Crypto Coin Chance