Ways to pick up free Bitcoin:

Method #1: Open an Uphold wallet using this link. Buy or sell $250 in crypto in the first 30 days, get $20 in free BTC.

Method #2: Sign up for Nexo using this link. Top up your account with $500 in crypto and complete a few tasks. Make sure your assets are still worth $500 in 30 days and you will receive $35 in free BTC.

Method #3: Open a Coinbase account using this link. Buy $20 in crypto, get $20 in free BTC.

Happy HODLING!

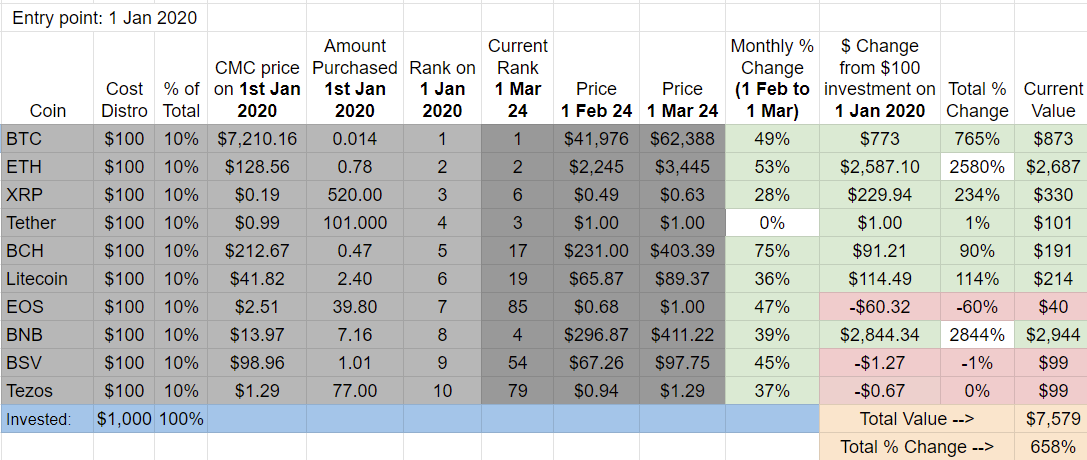

Month Fifty – UP 658%

The 2020 Top Ten Crypto Index Fund consists of: BTC, ETH, XRP, USDT, BCH, Litecoin, EOS, BNB, BSV, and Tezos.

February highlights for the 2020 Top Ten Portfolio:

- All green month

- BNB is in the overall lead, followed by ETH

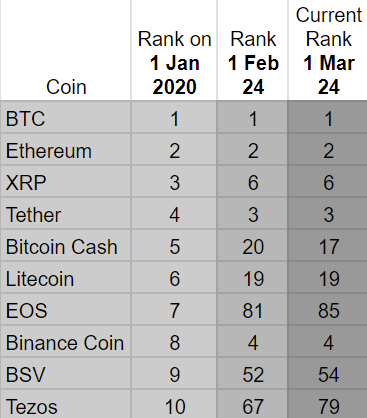

February Ranking and Dropout Report

Top Ten dropouts since January 2020: after fifty months, half of the cryptos that started in the Top Ten have dropped out: EOS, BSV, Tezos, Litecoin, and Bitcoin Cash have been replaced by Cardano, DOGE, SHIB, SOL, and USDC.

At #85, EOS has sunk the lowest since January 2020.

February Winners and Losers

February Winners – BCH (+75%) and ETH (+53%) were the best performers in the 2020 Top Ten Portfolio this month.

February Losers – No coin really lost this month, but XRP underperformed, returning “only” +28% in February.

Overall Update – BNB remains in first place, followed by second place ETH gains ground. Nine cryptos at break even or positive territory. 2020 Top Ten is the best performing Portfolio.

At +658%, the 2020 Top Ten Portfolio continues to be the best performing of the seven Top Ten Crypto Index Fund Experiments. 90% of the 2020 cryptos are in positive or break-even territory, EOS the lone exception.

Binance Coin continues to hold a significant lead, with ETH in a strong second place. The rest are significantly behind.

The initial $100 investment fifty months ago into first place Binance Coin? Currently worth $2,944, an increase of +2,844%.

In second place is Ethereum, up +2,580%.

EOS is the worst performer in the 2020 group, down -60% since January 2020.

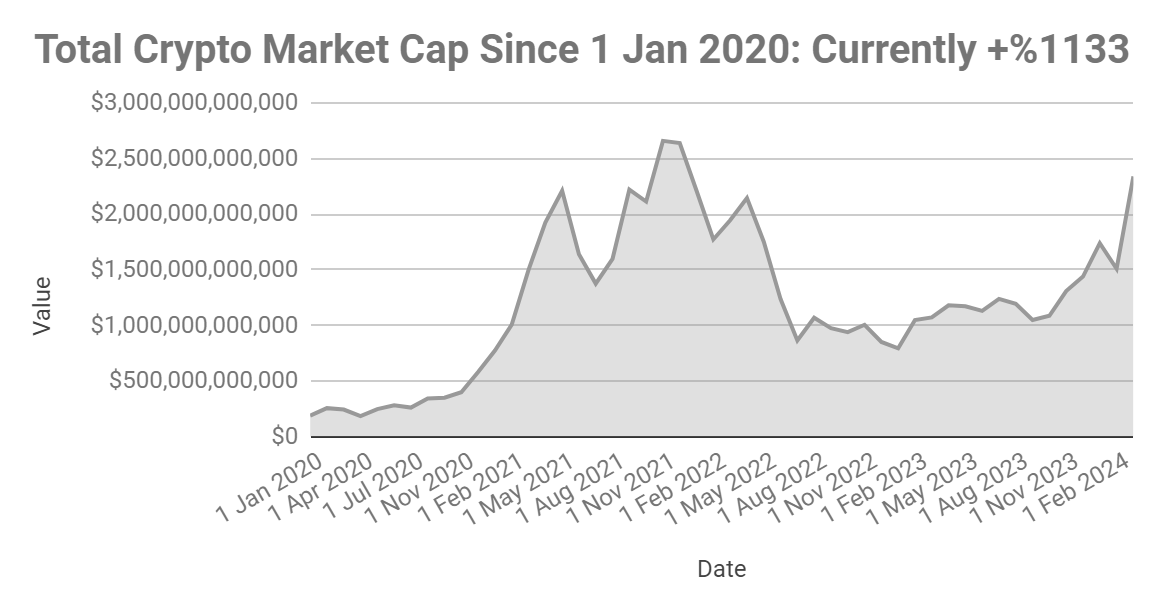

Total Market Cap for the Entire Cryptocurrency Sector:

As a sector, crypto is up +1133% over the fifty month lifespan of the 2020 Top Ten Experiment.

There was no easy way to do it at the time, but if you were able to capture the entire crypto market since January 2020 (+1130%), you’d be doing quite a bit better than the Experiment’s Top Ten approach (+658%) and ridiculously better than the S&P (+59%) over the same time period. Much more on the S&P below.

Crypto Market Cap Low Point in the 2020 Top Ten Crypto Index Experiment: $185B in March 2020 (aka Zombie Apocalypse).

Crypto Market Cap High Point in the 2020 Top Ten Crypto Index Experiment: $2.6T in October 2021.

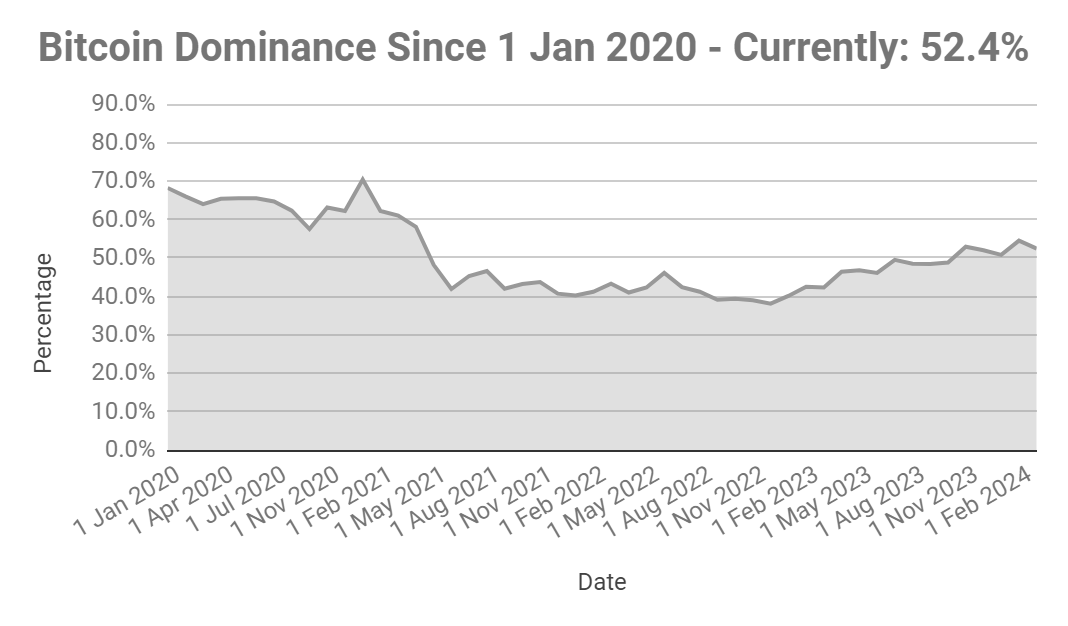

Bitcoin Dominance:

BitDom ended February at 52.4% and has seen a steady rise over the last few months.

Here are the high and low points of BTC domination since the beginning of the 2020 Experiment:

Low Point in the 2020 Top Ten Crypto Index Experiment: 38.1% in November 2022.

High Point in the 2020 Top Ten Crypto Index Experiment: 70.4% in December 2020.

Overall return on $1,000 investment since January 1st, 2020:

The 2020 Top Ten Portfolio is now worth $7,579 (+658%) from the initial $1k investment.

The 2020 Portfolio remains the best performing of the seven Experiments.

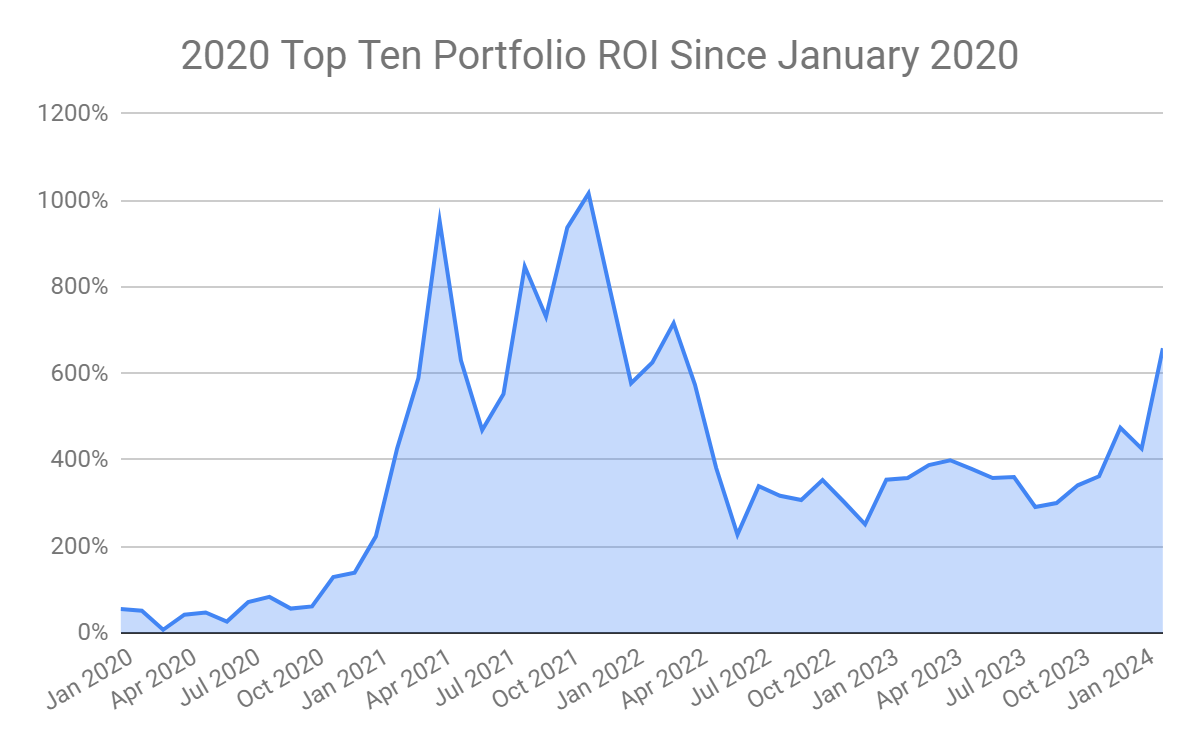

Below is a month by month ROI of the 2020 Top Ten Experiment, to give you a sense of perspective and provide an overview as we go along:

Combining the 2018, 2019, 2020, 2021, 2022, 2023, and 2024 Top Ten Crypto Portfolios

So what about combining seven years of the Top Ten Crypto Index Fund Experiments?

- 2018 Top Ten Experiment: up +21% (total value $1,210)

- 2019 Top Ten Experiment: up +510% (total value $6,098)

- 2020 Top Ten Experiment: up +658% (total value $7,579) (best performing portfolio)

- 2021 Top Ten Experiment: up +200% (total value $2,997)

- 2022 Top Ten Experiment: down -41% (total value $588) (worst performing portfolio)

- 2023 Top Ten Experiment: up +111% (total value $2,111)

- 2024 Top Ten Experiment: down +21% (total value $1,207)

Taking the seven portfolios together:

After a $7,000 total investment in the 2018, 2019, 2020, 2021, 2022, 2023, and 2024 Top Ten Cryptocurrencies, the combined portfolios are worth $21,790.

That’s up +211% on the combined portfolios. The peak for the combined Top Ten Index Fund Experiment Portfolios was November 2021’s all time high of +533%.

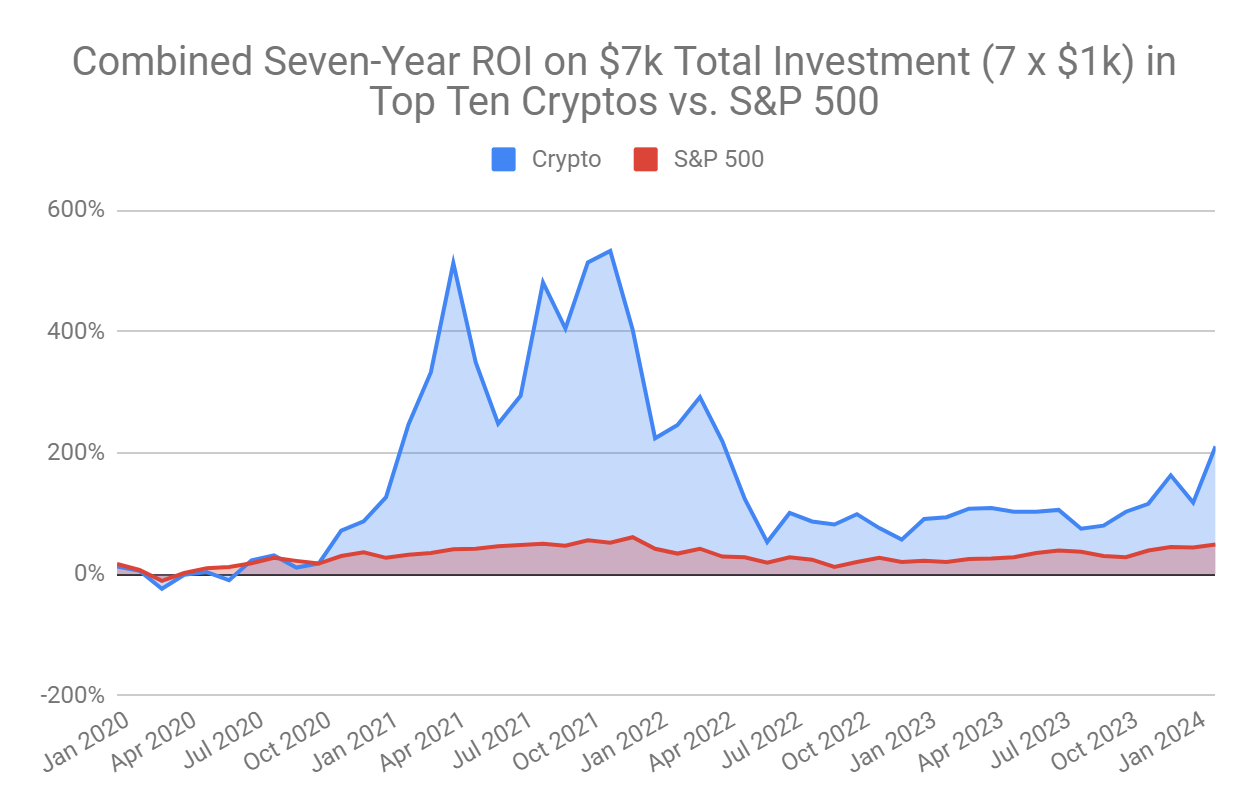

Lost in the numbers? Here’s a graph to help visualize the progress of the combined portfolios:

In summary: That’s a +211% gain by investing $1k on whichever cryptos happened to be in the Top Ten on January 1st (including stablecoins) for seven straight years.

Comparison to S&P 500

I’m also tracking the S&P 500 as part of my experiment to have a comparison point with traditional markets.

Since the S&P 500 has returned +59% since January 1st, 2020, that same $1k I put into crypto in January 2020 would be worth $1,590 had it been redirected to the S&P 500 instead.

Crypto over the same time period? The 2020 Top Ten Crypto Portfolio is returning +658%, worth $7,579.

That’s a difference of $5,989 on a $1k investment.

But that’s just 2020. What about other entry points? What if I invested in the S&P 500 the same way I did during the first seven years of the Top Ten Crypto Index Fund Experiments since January 1st, 2018, what I like to call the world’s slowest dollar cost averaging method? Here are the figures:

- $1000 investment in S&P 500 on January 1st, 2018 = $1,920 today

- $1000 investment in S&P 500 on January 1st, 2019 = $2,050 today

- $1000 investment in S&P 500 on January 1st, 2020 = $1,590 today

- $1000 investment in S&P 500 on January 1st, 2021 = $1,370 today

- $1000 investment in S&P 500 on January 1st, 2022 = $1,080 today

- $1000 investment in S&P 500 on January 1st, 2023 = $1,340 today

- $1000 investment in S&P 500 on January 1st, 2024 = $1,080 today

Taken together, the results for a similar approach with the S&P:

After seven $1,000 investments into an S&P 500 index fund in January 2018, 2019, 2020, 2021, 2022, 2023, and 2024 my portfolio would be worth $10,430.

That is up +49% since January 2018 compared to a +211% gain of the combined Top Ten Crypto Experiment Portfolios.

To help provide perspective, here’s a look at the combined five year ROI for crypto vs. the S&P up to this point.

Conclusion:

For those who have supported the Experiments over the years, thank you. For those just getting into crypto, I hope these monthly reports can somehow help with perspective as you embark on your crypto adventures. Buckle up, think long term, don’t invest what you can’t afford to lose, and most importantly, try to enjoy the ride.

A reporting note: I’ll focus on 2024 Top Ten Portfolio reports + one other portfolio on a rotating basis this year, so expect two reports per month. February’s extended report covers the one you’re reading here, the 2020 Top Ten Portfolio. You can check out the latest 2018 Top Ten, 2019 Top Ten, 2021 Top Ten, 2022 Top Ten, and 2023 Top Ten reports as well.

This article contains affiliate links. If you click on a link in this article, I may earn a small commission at no extra cost to you.

Help keep the lights on at the Top Ten Crypto Index Fund Experiments.

Donate directly:

Bitcoin: bc1qqy4tlwydyrm3sjpyyq88es0cu9j9mdvqer3gwv

Ethereum: 0xC04Bc1996320f27c0A6018cB370c9469a9Dd3a4C

ADA: addr1qywnu55t8hpk4c3jf63tj5xywzej0uhwh7yput4u2z3fq7qa8efgk0wrdt3ryn4zh9gvgu9nylewa0ugrchtc59zjpuqlj6stg

XLM: GA5GJ2JDWC3GB3YXEVRBSR7UBLIB2ROIWZ5FEHML5WXGY5N3PAIDEOEA

Pingback: Tracking 2019 Top Ten Cryptocurrencies – Month Sixty-Seven - Top Ten Crypto Index Fund Experiments

Pingback: $1k invested into the Top 10 Cryptos on January 1st, 2020 Up +658% (FEB Update - Month 50) - NFT-BOX

Pingback: $1k invested into the Top 10 Cryptos on January 1st, 2020 Up +658% (FEB Update – Month 50) – DarkFiberMines.com