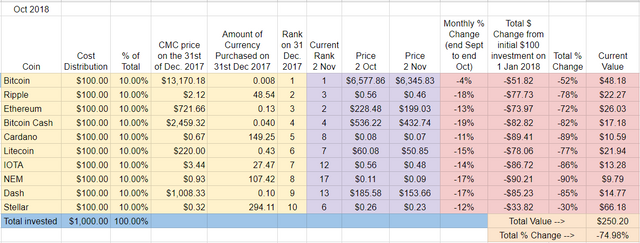

Month/Episode Ten – Down 75%

Like September, October ended up being pretty Paul Giamatti (Sideways). This is quite unusual for crypto this year, especially considering the wild fluctuations we saw in traditional markets. That said, none of the original Top Ten cryptos ended the month in the green, so while the flow may have slowed, this portfolio continues to bleed. In fact, this Top Ten portfolio reached a grim milestone: I am down a full 75% since the beginning of the year – my $1k investment is now worth $250 bucks.

October “Winners” – It was Bitcoin this month, holding remarkable steady, down only about 4% on the month. Cardano finished in second place “only” down 11% and moving up a position in the ranking from #9 to #8.

October Losers – Bitcoin Cash lost -19% of its value in October followed closely by Ripple, NEM, and Dash each down -17 or -18%.

Overall update – Stellar retains lead, BTC a distant second. NEM and Cardano at the bottom

October’s report could have written itself (which I guess is interesting if we’re looking for patterns). Although down -30% for the year, Stellar remains squarely in the lead, followed distantly by Bitcoin down -52% for the year. This is not a surprise to anyone who’s been following the experiment – Stellar has been one of the strongest cryptos most if not all months this year. That said, BTC did close the gap a bit in October by being so stable this month while the alts slipped more significantly.

NEM and Cardano are both at or near the -90% mark since January 1st. My initial $100 investment in NEM and Cardano at the beginning of the year is now worth about $10 bucks each. IOTA and Dash closely follow, down -86% and -85% on the year, respectively.

In terms of ranking, only Cardano made a positive move this month, rising from #9 to #8 in October. IOTA and Dash fell a place each and now sit at #12 and #13 respectively. NEM, Dash, and IOTA are Top Ten dropouts – they have been replaced by EOS (now at #5), Tether (currently at #10), and Monero (currently at #9).

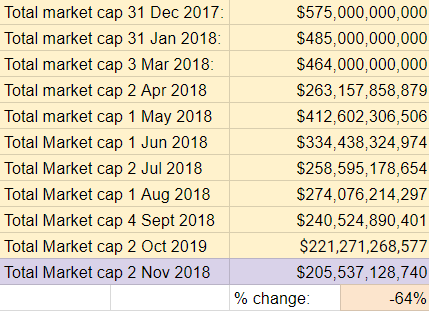

Total Market Cap for the entire cryptocurrency sector:

As mentioned earlier, October was a slow bleed, not a massive drop. Yes, the total market cap for crypto is now at its lowest month-end point of the year, but a relatively modest drop. From January 1st the market has lost -64% of its total value. Crypto hasn’t ended a month above $300B since the end of May.

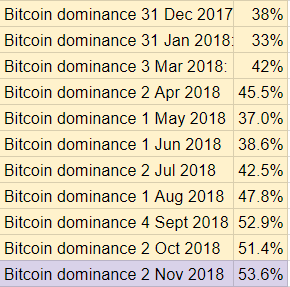

Bitcoin dominance:

Fairly flat here as well again, but Bitcoin dominance did reach its month-end high of 53.6% in October. As we’ve seen this throughout the experiment, when the overall market dives, BTC‘s dominance increases. This appears to be the case when the market is going sideways as well, or at least that was the case this month.

Overall return on investment from January 1st, 2018:

If I cashed out today, my $1000 initial investment would return $250, down -75%. I’m officially at the lowest point in terms of value.

Implications/Observations:

Zero cryptos finished the month in positive territory, but the way this year has been going, a relatively steady month isn’t horrible news. A breakout (one way or the other) that I expected to happen in October didn’t come to pass. All in all it was a fairly boring/sideways month in crypto.

Although it gave up some ground to Bitcoin this month, Stellar continues to be the crypto to beat in 2018 with only 60 days left to go.

Focusing solely on holding the Top Ten continues to be a losing strategy. While the overall market is down -64% from January, the cryptos that began 2018 in the Top Ten are down -75% over the same period of time. At no point in the experiment has this investment strategy worked: the initial Top Ten continue to under-perform compared to the market overall.

Last month that gap appeared to be shrinking as I reported a 9% difference, but this month it’s back to 11%.

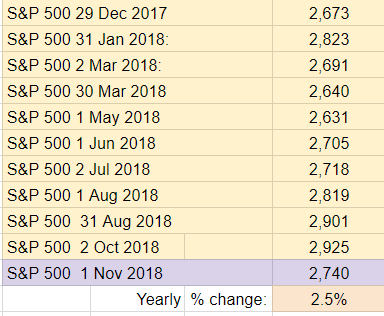

I’m also tracking the S&P 500 as part of my experiment to have a comparison point with other popular investments options. October was a volatile month – many of the gains obtained over the last few months were erased. The S & P 500 finished October up about 2.5% on the year meaning my $1k investment would have given me $25 on the year.

Conclusion:

Yet another down month, but again very sideways. This is the second month in a row the crypto space has been relatively “boring” in terms of price action while the stock market had a bit of a wild ride. I’d be surprised if something doesn’t shake out soon and am guessing that by the time I compile this report at the end of November, there will be a significant movement one way or another.

Thanks for reading and the support for the experiment. I hope you’ve found it helpful. I continue to be committed to seeing this process through and reporting along the way. Feel free to reach out with any questions and stay tuned for progress reports.

As the year winds down, I haven’t decided yet what to do with the experiment after December. If any one has suggestions, let me know in the comments.

This article contains affiliate links. If you click on a link in this article, I may earn a small commission at no extra cost to you.

Help keep the lights on at the Top Ten Crypto Index Fund Experiments.

Donate directly:

Bitcoin: bc1qqy4tlwydyrm3sjpyyq88es0cu9j9mdvqer3gwv

Ethereum: 0xC04Bc1996320f27c0A6018cB370c9469a9Dd3a4C

ADA: addr1qywnu55t8hpk4c3jf63tj5xywzej0uhwh7yput4u2z3fq7qa8efgk0wrdt3ryn4zh9gvgu9nylewa0ugrchtc59zjpuqlj6stg

XLM: GA5GJ2JDWC3GB3YXEVRBSR7UBLIB2ROIWZ5FEHML5WXGY5N3PAIDEOEA