This article contains affiliate links. If you click on a link in this article, I may earn a small commission at no extra cost to you.

Recommended Storage:

For crypto storage, my recommended hardware wallet is the Ledger Nano X.

Recommended Exchange:

On solid financial footing and ready to purchase crypto? My recommended exchange is Binance.

Get up to $59 of FREE COMP with Coinbase Earn

AND Get up to $50 of FREE XLM with Coinbase Earn

Considering getting into cryptocurrencies?

Be prepared for a wild ride.

In fact, I recommend getting your financial house in order first.

Month Thirty Three – Down 76%

After a rough start to September, crypto spent the month trying in vain to claw back ground. While a few coins rebounded quite a bit from the monthly lows, most ended up finishing the month significantly down. Out of the 2018 Top Ten group, Bitcoin lost the least, down -8% in September. NEM followed it’s winning August (yes, you read that right) with the poorest performance, down -26%.

Question of the month:

Which cryptocurrency exchange won approval to create America’s first crypto bank in September?

A) Binance

B) Binance.us

C) Kraken

D) Coinbase

Scroll down for the answer.

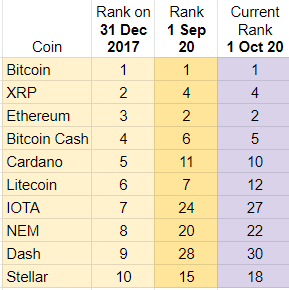

Ranking and September Winners and Losers

A lot of shuffling in September. On the upside, Bitcoin Cash and Cardano gained one place each landing at #5 and #10 respectively. Cardano gets special mention for re-entering the Top Ten.

Heading the wrong direction were IOTA, NEM, Dash, and Stellar each falling two or three spots.

The big story though, for long time crypto watchers, was the ejection of Litecoin from the Top Ten, down five places from #7 to #12 in just one month. For some context, Litecoin’s absence from the Top Ten is a Top Ten Experiment first. It is also the first time since CoinMarketCap has tracked crypto rankings that Litecoin has not been in the Top Ten.

Drop outs: After thirty-three months of this experiment 50% of the cryptos that started 2018 in the Top Ten have dropped out. NEM, Litecoin, Dash, IOTA, and Stellar have been replaced by Binance Coin, Tether, BSV, LINK, and most recently, DOT.

September Winners – Although it lost -8% of its value, this month’s W goes to Bitcoin. ADA gets second place, down -15% and climbing back into the Top Ten.

September Losers – As most probably expected after an extremely out of character victory last month, NEM came back down to earth in September, bigly, down -26%. Litecoin finished right behind, down -24% and dropping out of the Top Ten.

For the overly competitive, below is a tally of the winners of the first 33 months of the 2018 Top Ten Crypto Index Fund Experiment. Bitcoin still has the most monthly wins (8) and Cardano in second place with 6 monthly wins. With its poor September performance, NEM now has 7 monthly losses.

Every crypto has at least one monthly win and Bitcoin is unique as the only cryptocurrency that hasn’t lost a month yet since January 2018.

Overall update – BTC solidly in the lead, followed by ETH. Dash in the basement, LTC drops out of the Top Ten.

Even though BTC took a bit of a detour on its way back to break-even point, it is still far ahead of the field, down -17% since January 2018. The initial investment of $100 thirty-three months ago is now worth about $83. Second place Ethereum is down -49% over the same time period.

At this point in the 2018 Top Ten Experiment, Dash is at the bottom. It is currently worth $70.49, down from a January 1st, 2018 starting price of over $1,000. That’s a loss of -93%. The initial $100 invested in Dash 33 months ago is now worth $6.77.

The big story this month is LTC’s departure from the Top Ten, the first time since I started the experiment back in January 2018. Whether or not it will eventually fend off the new generation of coins remains to be seen, but it certainly is noteworthy to have one of the most well known and long standing cryptos drop out of the Top Ten. Consider pouring one out for Litecoin.

Total Market Cap for the entire cryptocurrency sector:

The crypto market lost over $35B in September and is down -39% since January 2018. The value of the overall crypto market is near where it was in August of this year, just a few months back. As painful as the beginning of the month was, looking at a table like this helps with perspective, especially if you’re panic prone.

Bitcoin dominance:

After steadily dipping for months, BitDom increased a bit in September, up to 57.5%.

For some context: since the beginning of the experiment, the range of Bitcoin dominance has been quite wide: we saw a high of 70% BitDom in September 2019 and a low of 33% BitDom in February 2018.

Overall return on $1,000 investment since January 1st, 2018:

The 2018 Top Ten Portfolio lost -$50 this month. If I cashed out today, the $1000 initial investment would return about $238, down -76% from January 2018.

September broke an encouraging upward trend, but at least the portfolio is taking a break from the -80% range. Here’s a look at the ROI over the life of the experiment, month by month, for some context:

The absolute bottom was -88% back in January 2019.

So the Top Ten Cryptos of 2018 are down -76%. What about the 2019 and 2020 Top Tens? Let’s take a look:

- 2019 Top Ten Experiment: up +54% (total value $1,538)

- 2020 Top Ten Experiment: up +56% (total value $1,564)

So overall? Taking the three portfolios together, here’s the bottom bottom bottom line:

After a $3000 investment in the 2018, 2019, and 2020 Top Ten Cryptocurrencies, my combined portfolios are worth $3,340 ($238+ $1,538 +$1,564).

That’s up about +11% for the three combined portfolios, compared to +31% last month.

Here’s a table to help visualize:

That’s a +11% gain by investing $1k on whichever cryptos happened to be in the Top Ten on January 1st for three straight years.

But surely you’d do better if you went all in on one crypto, right?

Depends on your choice. Let’s take a look:

Only five cryptos have started in the Top Ten for all three years: BTC, ETH, XRP, BCH, and LTC (unless Litecoin can make a comeback by the 1st of Jan. 2021, it’s not going to make the four year club!). Knowing what we know now, which one would have been best to go all in on?

Ethereum, by a pretty good margin: the initial $3k would be up +104%, worth $6,118 today. The worst choice of a basket to put all your eggs in at this point in the experiment is XRP, down by almost one third.

Comparison to S&P 500:

I’m also tracking the S&P 500 as part of the experiment to have a comparison point with other popular investments options. The S&P 500 Index fell from an all time high in August, but is currently up +26% since January 2018.

The initial $1k investment into crypto on January 1st, 2018 would have been worth about $1260 had it been redirected to the S&P.

But what if I took the same invest-$1,000-on-January-1st-of-each-year approach with the S&P 500 that I’ve been documenting through the Top Ten Crypto Experiments? Here are the numbers:

- $1000 investment in S&P 500 on January 1st, 2018 = $1260 today

- $1000 investment in S&P 500 on January 1st, 2019 = $1350 today

- $1000 investment in S&P 500 on January 1st, 2020 = $1050 today

Taken together, here’s the bottom bottom bottom line for a similar approach with the S&P:

After three $1,000 investments into an S&P 500 index fund in January 2018, 2019, and 2020, my portfolio would be worth $3,660.

That is up +22% since January 2018, compared to a +11% gain of the combined Top Ten Crypto Experiment Portfolios.

That’s an 11% swing in favor of the S&P 500 and breaks a two month mini-streak of wins from the Top Ten crypto portfolios.

That’s seven monthly victories for the S&P vs. two monthly victories for crypto. The largest gap so far was a 22% difference in favor of the S&P in June.

Conclusion:

September was a tough month for both traditional and crypto markets. What’s next for the rest of 2020? More volatility is no doubt to come as we enter the last quarter of a truly unpredictable and exhausting year. Buckle up.

Thanks for reading and for supporting the experiment. I hope you’ve found it helpful. I continue to be committed to seeing this process through and reporting along the way. Feel free to reach out with any questions and stay tuned for progress reports. Keep an eye out for my parallel projects where I repeat the experiment twice, purchasing another $1000 ($100 each) of two new sets of Top Ten cryptos as of January 1st, 2019 then again on January 1st, 2020.

And the Answer is…

C) Kraken

According to an official announcement in September, Kraken is “the first digital asset company in U.S. history to receive a bank charter recognized under federal and state law.”

Help keep the lights on at the Top Ten Crypto Index Fund Experiments.

Donate directly:

Bitcoin: 1Pwz1gABZd2jkfFrjSZbJmD3te3dFYjhJo

Ripple: rEVxyudxYfPDFiV9qVZU8m7v2w9vwc4UCj

Ethereum: 0xf1df4ae19e80dd195ac67281598d84C4D6df029f

Pingback: 加密PK傳統資產:今年十大加密貨幣略勝一籌,標普500長期回報更穩健 | 鏈新聞 ABMedia