This article contains affiliate links. If you click on a link in this article, I may earn a small commission at no extra cost to you.

Month Twenty-Seven – Down 87%

Welcome to the special COVID/Zombie Apocalypse version of the update. An all red month, but, meh, this is cypto, we’re used to it.

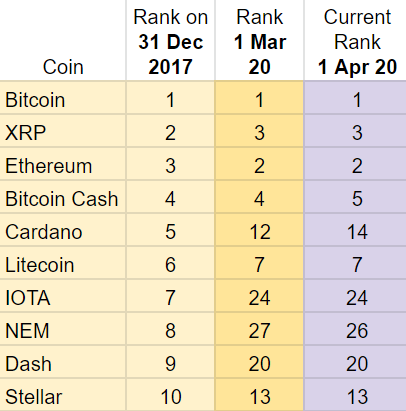

Ranking and March Winners and Losers

For such a crazy month, there wasn’t much movement with this group. For the second month in a row, Cardano fell two positions and Bitcoin Cash slipped one slot. NEM was the only crypto to climb, up one position in March. Always got to take the opportunity to report something positive about NEM!

The overall drop out rate is still at 50% mark (meaning half of the cryptos that started 2018 in the Top Ten have dropped out). NEM, Dash, IOTA, Cardano, and Stellar have been replaced by EOS, Binance Coin, Tezos, Tether, and BSV.

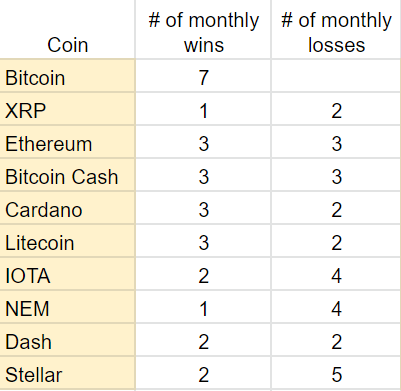

March Winners – Bitcoin squeaked out a victory in March, although BTC was basically in a three way tie this month with XRP and Dash. All were down -23%.

March Losers – In an all red month, ETH and Cardano did especially poorly, down -38% and -33% respectively.

Below is tally of which coins have the most monthly wins and losses in the first 27 months of the 2018 Top Ten Crypto Index Fund Experiment. Most monthly wins (7): Bitcoin. Most monthly losses (5): Stellar. All cryptos have at least one monthly win and Bitcoin now stands alone as the only crypto that hasn’t lost a month (although it came close in January 2020), when it gained “only” +31%).

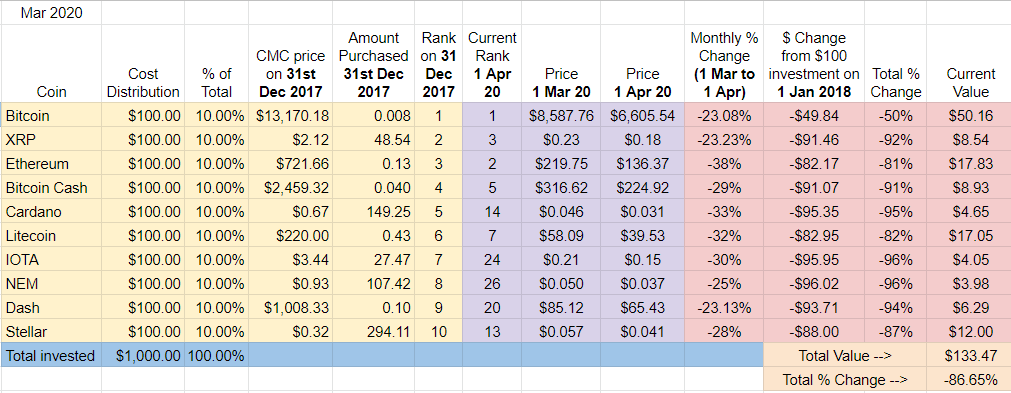

Overall update – BTC far ahead, ETH and LTC virtually tied for second place, IOTA and NEM virtually tied for last place.

Although down -50% from January 2018, Bitcoin is still well ahead of the field. Ethereum and Litecoin are almost tied for second place, down -81% and -82% respectively.

While NEM technically remains in the basement, IOTA is knocking at the door. Both are down -96%, and IOTA is now only a few cents off in total return.

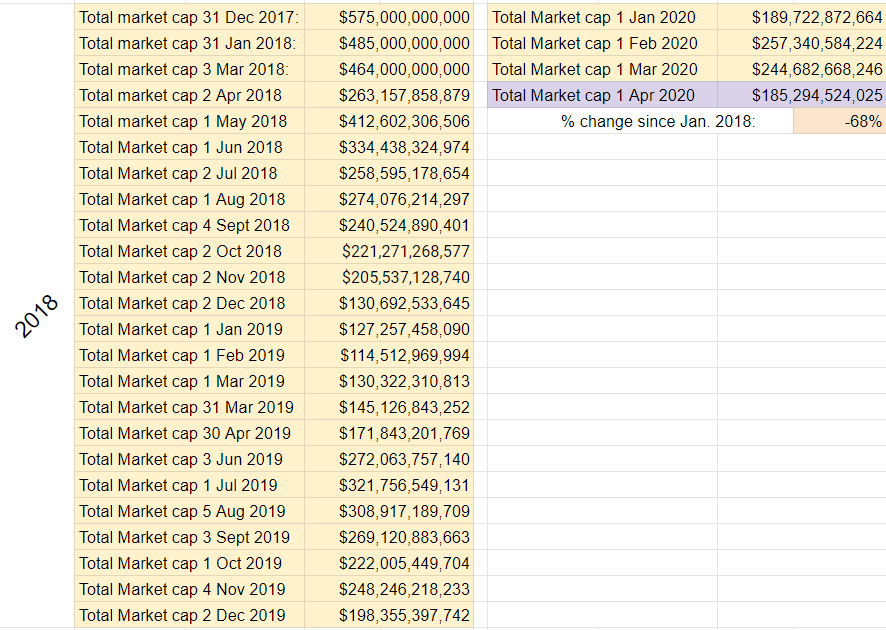

Total Market Cap for the entire cryptocurrency sector:

The overall crypto market lost about $60B in March 2020 and is now down -68% from January 2018.

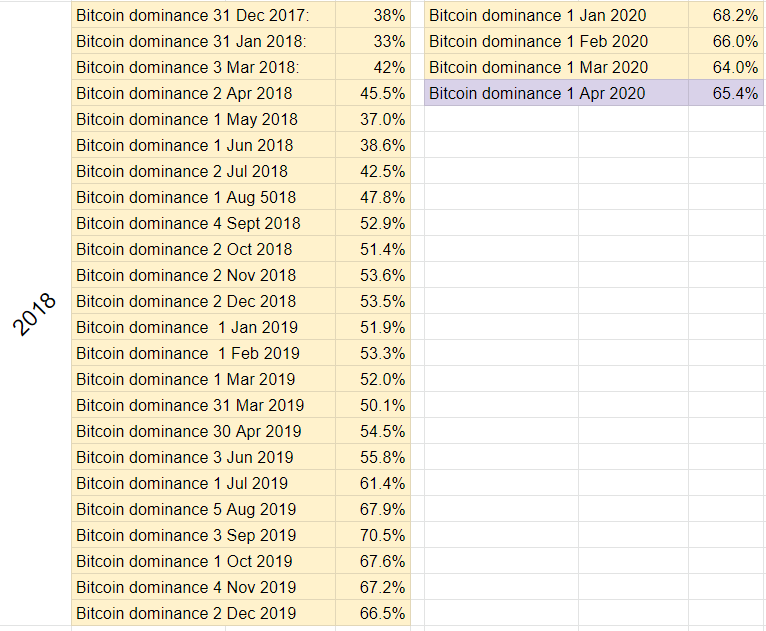

Bitcoin dominance:

Bitcoin dominance bounced up about +1.5% in March, something we’ve seen time and time again over the course of the experiment when the market bleeds. For context, the range since the beginning of the experiment in January 2018 has been quite wide: a high of 70% in September 2019 and a low of 33% in February 2018.

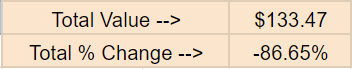

Overall return on investment since January 1st, 2018:

The 2018 Top Ten Portfolio lost about $53 bucks in March 2020. If I cashed out today, my $1000 initial investment would return about $133, down -87% from January 2018. This isn’t quite the low point for the 2018 Top Ten (the portfolio was down -88% in January 2019) but pretty close.

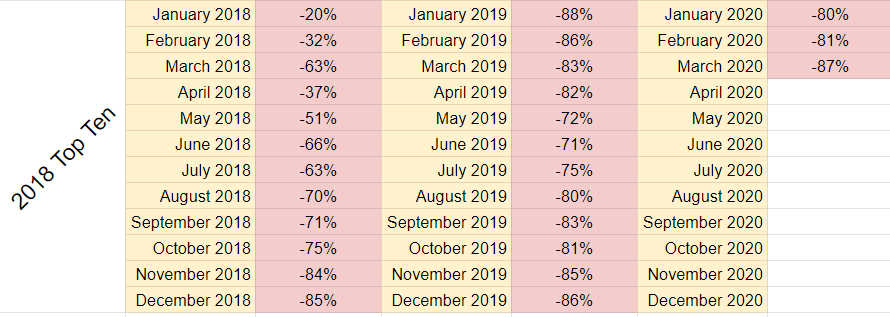

See, here’s the ROI over the life of the experiment, month by month:

A sea of red. The closest the 2018 Top Ten group has come to breaking even was after the very first month, when the portfolio was down “only” -20%. March 2020 is now the eighth consecutive time the portfolio has ended the month down at least -80%.

The 2019 and 2020 Top Ten Experiments are still in positive territory, but not by much:

- 2019 Top Ten Experiment: up about +6.5% ($1,065)

- 2020 Top Ten Experiment: up about +6.9% ($1,069)

Taking the three portfolios together, here’s the bottom bottom bottom line:

After a $3000 investment in the 2018, 2019, and 2020 Top Ten Cryptocurrencies, my portfolios are worth $2,267.

After finally, at sweet long last, ending the first few months of 2020 in positive territory for the combined portfolios (January up +13% and February up +6%), that’s down about -24% total. Thanks coronavirus.

Alright, but it’s the end of the world as we know it, everything’s tanking. How does this compare to traditional markets?

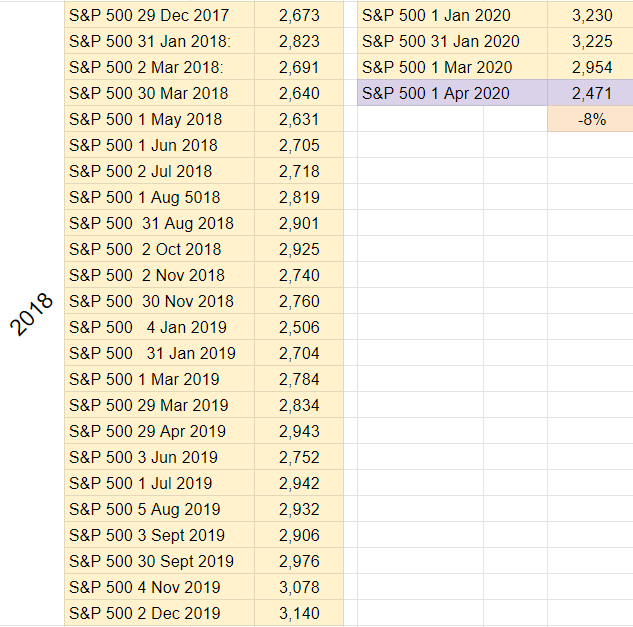

Comparison to S&P 500:

I’m also tracking the S&P 500 as part of my experiment to have a comparison point with other popular investments options. March 2020 was not a great month for the S&P: it lost over -20% of its value this month and is currently at the lowest point since the experiment began in January 2018: -8% since the start of 2018. The initial $1k investment into crypto would have lost me about -$80 had it been redirected to the S&P.

Taking the same drop-$1,000-per-year-on-January-1st approach with the S&P 500 that I’ve been documenting through the Top Ten Crypto Experiments would yield the following:

- $1000 investment in S&P 500 on January 1st, 2018: -$80

- $1000 investment in S&P 500 on January 1st, 2019: -$10

- $1000 investment in S&P 500 on January 1st, 2020: -$230

Taken together, here’s the bottom bottom bottom line for a similar approach with the S&P:

After three $1,000 investments into an S&P 500 index fund in January 2018, 2019, and 2020, my portfolio would be worth $2,680.

That’s down about -11% compared to -24% with the Top Ten Crypto Experiment Portfolios.

That’s a 13% difference. Last month the gap was only 1%.

Implications/Observations:

The experiment’s focus of solely holding the Top Ten Cryptos has never been a winning approach when compared to the overall market. The total market cap is down -68% from January 2018 compared to the -87% for the cryptos that began 2018 in the Top Ten. This of course implies that I would have done a bit better if I’d picked different cryptos.

At no point in this experiment has this investment strategy been successful: the initial 2018 Top Ten have under-performed each of the twenty-seven months compared to the market overall.

There are a few examples of this approach outperforming the overall market in the parallel 2019 Top Ten Crypto Experiment, but these cases are few and far between. In contrast, each of the first three months of the 2020 Experiment show that focusing on the Top Ten beats the overall market.

Conclusion:

With COVID affecting the entire globe and no end in sight, the next few months will be tough. We should have a better idea whether crypto is seen as a gold-like safe haven during tough times, as some have suggested.

Final word: take care of yourselves, your families, and your communities. Keep up the social distancing, bend the curve, wash your hands. Be careful out there.

Thanks for reading and for supporting the experiment. I hope you’ve found it helpful. I continue to be committed to seeing this process through and reporting along the way. Feel free to reach out with any questions and stay tuned for progress reports. Keep an eye out for my parallel projects where I repeat the experiment twice, purchasing another $1000 ($100 each) of two new sets of Top Ten cryptos as of January 1st, 2019 then again on January 1st, 2020.

This article contains affiliate links. If you click on a link in this article, I may earn a small commission at no extra cost to you.

Help keep the lights on at the Top Ten Crypto Index Fund Experiments.

Donate directly:

Bitcoin: bc1qqy4tlwydyrm3sjpyyq88es0cu9j9mdvqer3gwv

Ethereum: 0xC04Bc1996320f27c0A6018cB370c9469a9Dd3a4C

ADA: addr1qywnu55t8hpk4c3jf63tj5xywzej0uhwh7yput4u2z3fq7qa8efgk0wrdt3ryn4zh9gvgu9nylewa0ugrchtc59zjpuqlj6stg

XLM: GA5GJ2JDWC3GB3YXEVRBSR7UBLIB2ROIWZ5FEHML5WXGY5N3PAIDEOEA

Pingback: I bought $1k of the Top 10 Cryptos on January 1st, 2018 (JUNE Update/Month 42) - Folks Library News

Pingback: I bought $1k of the Top 10 Cryptos on January 1st, 2018 (JUNE Update/Month 42) - NFT-BOX

Pingback: I bought $1k of the Top 10 Cryptos on January 1st, 2018 (MAY Update/Month 41)

Pingback: I bought $1k of the Top 10 Cryptos on January 1st, 2018 (April Update/Month 40)

Pingback: I bought $1k of the Top 10 Cryptos on January 1st, 2018 (April Update/Month 40) – DarkFiberMines.com

Pingback: I bought $1k of the Top 10 Cryptos on January 1st, 2018 (March Update/Month 39) : CryptoCurrency - Go Coin It

Pingback: I bought $1k of the Top Ten Cryptos on January 1st, 2018. Result? Down -81% : CryptoCurrency | https://cryptoyaks.com

Pingback: EXPERIMENT – Tracking Top 10 Cryptos of 2018 – Month 28 Update (Down -82%) | Forex Overlay

Pingback: Zombie Apocalypse Edition – I bought $1000 worth of the Top Ten Cryptos on January 1st, 2018 (March 2020 Update) | News