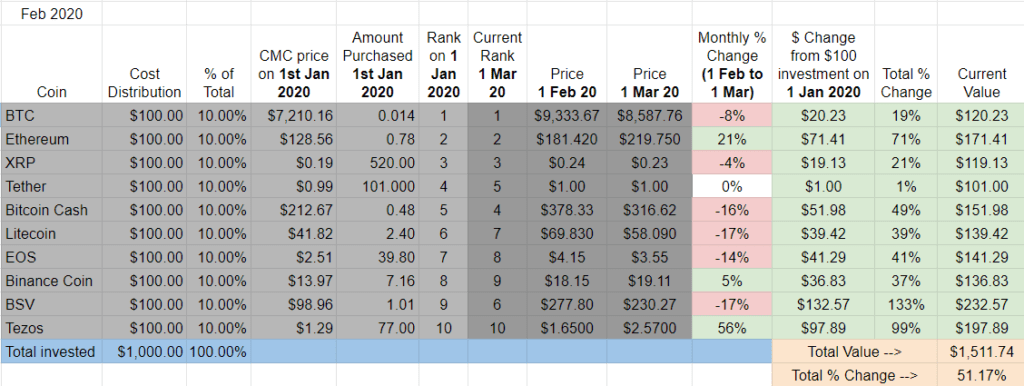

Month Two – UP 51%

Despite an overall down month, the damage was mitigated by the strong performances of both Tezos and Ethereum. The 2020 Top Ten Portfolio is now the best performing of the three.

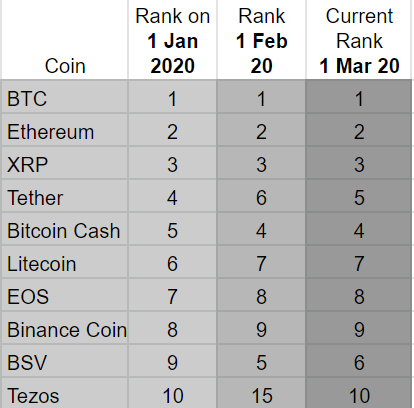

Ranking and February Winners and Losers

A stable month rank-wise with only three of the 2020 Top Ten moving in February. BSV fell one spot. Tether moved upward (never a good sign) from #6 to #5. Tezos, after crashing hard last month, bounced right back up to #10 from #15. Welcome back to the Top Ten.

February Winners – Tezos outperformed the field easily in February, ending the month +56%. Ethereum also had a strong month, up +21%.

February Losers – BSV and Litecoin both finished the month by losing -17% in value. Since they’re basically tied, I’ll go ahead and give the loss to BSV which also fell one place in the rankings while Litecoin stayed put. Close behind was Bitcoin Cash, down -16%.

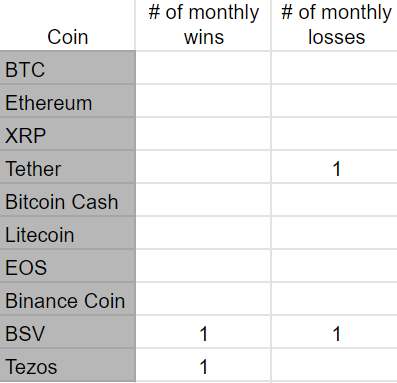

For those keeping score, I also keep a tally of which coins have the most monthly wins and losses. Still too early to have a clear overall winner or loser:

Overall update – BSV maintains strong lead, followed by Tezos. All others in positive territory.

BSV is up +133% so far, the clear front runner at this point in the year. Tezos, with a strong February, is solidly in second place, up nearly 100% since January 1st, 2020. Not counting Tether, Bitcoin has performed the worst in 2020 (although it’s still up 19% on the year).

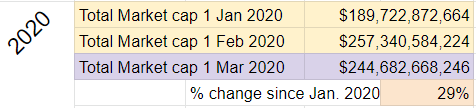

Total Market Cap for the entire cryptocurrency sector:

The crypto market lost about $12B and crypto watchers had this reaction. Since the beginning of 2020, the market as a whole is up +29%.

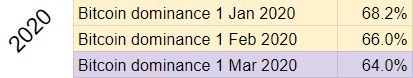

Bitcoin dominance:

Bitcoin dominance dipped a few more percentage points in February, finishing the month at 64%. That’s down about 4% since the beginning of the year and shows an increased appetite for altcoins at the moment.

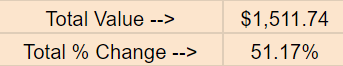

Overall return on investment since January 1st, 2020:

The 2020 Top Ten Portfolio lost about $40 in February 2020. After an initial $1000 investment, the 2020 Top Ten Portfolio is worth $1,511. That’s up about +51%.

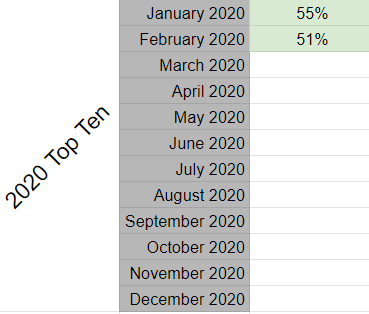

There’s still not much here at the moment, but this is where I’ll track the month by month ROI of the entire experiment in an attempt to maintain perspective and provide an overview as we go along:

How does the 2020 Top Ten Experiment compare to the parallel projects?

- 2018 Top Ten Experiment: down 81% (total value: $186)

- 2019 Top Ten Experiment: up about +47% (total value: $1,472)

Taken together, here’s the bottom bottom bottom line:

After a $3000 investment in the 2018, 2019, and 2020 Top Ten Cryptocurrencies, my portfolios are worth $3,170.

That’s up about +5.6%.

Implications/Observations:

The crypto market as a whole is up about +29% since the beginning of the year and the 2020 Top Ten cryptos have gained +51%. Focusing on the Top Ten 2020 coins has handily beaten the overall market two months in a row.

This is hasn’t happened very often since I started these experiments in January 2018. Although there are a few examples of the Top Ten strategy outperforming the overall market in the 2019 Top Ten Experiment, it’s interesting to note at no point in the first twenty-six months of the Top Ten 2018 Experiment has the approach of focusing on the Top Ten cryptos outperformed the overall market. Not even once.

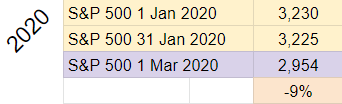

I’m also tracking the S&P 500 as part of my experiment to have a comparison point with other popular investments options. The S&P 500 was took a coronavirus nosedive in February and is now down -9% in 2020.

The initial $1k investment I put into crypto would now be worth $910 had it been redirected to the S&P 500.

And if I took the same world’s-slowest-dollar-cost-averaging/$1,000-per-year-in-January approach with the S&P 500? Here are the figures:

- $1000 investment in S&P 500 on January 1st, 2018: +$110

- $1000 investment in S&P 500 on January 1st, 2019: +$180

- $1000 investment in S&P 500 on January 1st, 2020: -$90

Taken together, here’s the bottom bottom bottom line:

After three $1,000 investments into an S&P 500 index fund in January 1st, 2018, 2019, and 2020, my portfolio would be worth $3,200.

That’s up about +6.7% compared to +5.6% with the Top Ten Crypto Experiments, the narrowest gap since I started the updates in January 2018.

Conclusion:

Due to coronavirus fears, the ROI gap between what these experiments are yielding vs. what the stock market would have yielded using the same approach is narrower than ever before. If investors consider crypto a safe haven during this period of massive global volatility, next month’s report may finally tip the scale in favor of the Top Ten Crypto portfolios.

Thanks for reading and for supporting the experiment. I hope you’ve found it helpful. I continue to be committed to seeing this process through and reporting along the way. Feel free to reach out with any questions and stay tuned for progress reports. Keep an eye out for the original 2018 Top Ten Crypto Index Fund Experiment and the 2019 Top Ten Experiment follow up experiment.

This article contains affiliate links. If you click on a link in this article, I may earn a small commission at no extra cost to you.

Help keep the lights on at the Top Ten Crypto Index Fund Experiments.

Donate directly:

Bitcoin: bc1qqy4tlwydyrm3sjpyyq88es0cu9j9mdvqer3gwv

Ethereum: 0xC04Bc1996320f27c0A6018cB370c9469a9Dd3a4C

ADA: addr1qywnu55t8hpk4c3jf63tj5xywzej0uhwh7yput4u2z3fq7qa8efgk0wrdt3ryn4zh9gvgu9nylewa0ugrchtc59zjpuqlj6stg

XLM: GA5GJ2JDWC3GB3YXEVRBSR7UBLIB2ROIWZ5FEHML5WXGY5N3PAIDEOEA

Pingback: I bought $1000 worth of the Top Ten Cryptos on January 1st, 2018 (Feb 2020 Update) | News

Pingback: I bought $1000 worth of the Top Ten Cryptos on January 1st, 2020 (Feb 2020 Update) | News