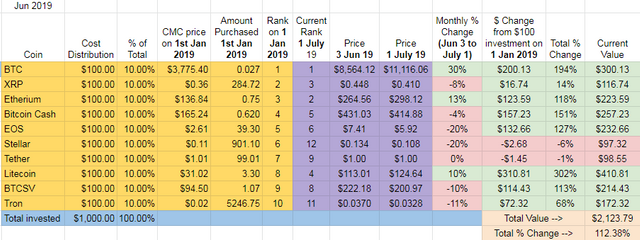

Month Six – Up 112%

Although the chart shows 70% of the Top Ten in the red, we only saw a small decline in value (-2%) for the coins associated with the 2019 Experiment thanks to Bitcoin‘s strong June. Although this technically snaps the four month win streak, the 2019 Top Ten portfolio is still up +112% on the year.

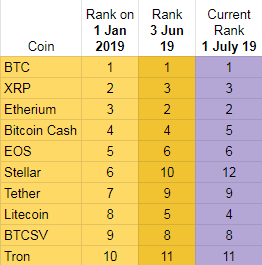

Ranking

Most of the Top Ten cryptos held their ground this month. Stellar continued its descent slipping two slots and out of the Top Ten to #12. The most significant move this month was probably Litecoin switching places with Bitcoin Cash. Litecoin now sits at #4, Bitcoin Cash at #5.

Stellar has joined Tron as the two cryptos to drop out of the Top Ten. They have been replaced by Binance Coin and Cardano.

June Winners – Only three cryptos in the 2019 Top Ten Experiment ended June in the green. Bitcoin dominated the headlines for good reason – even after a significant correction at the end of the month, it is still up 30% in June. ETH finished second, up 13%, followed by Litecoin, up 10%.

June Losers – Although Stellar and EOS are both down -20% in June, I have to give the loss this month to Stellar, which also fell two places in the rankings to #12, dropping out of the Top Ten.

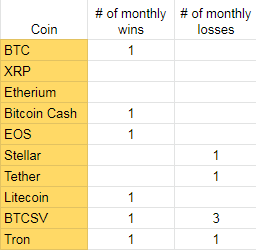

For those keeping score, here is tally of which coins have the most monthly wins and loses during the first six months of this experiment: Bitcoin, Bitcoin Cash, EOS, Litecoin, BTCSV, and Tron each have one victory each. Bitcoin SV has lost three out of the first six months.

Overall update – Litecoin maintains its lead, all cryptos in positive territory except Stellar

Although Bitcoin snagged most of the headlines in June, it’s Litecoin that continues to lead, up over +300% on the year. My initial $100 investment in Litecoin is now worth $411. Bitcoin made up a ton of ground this month though and now is in second place, up almost +200% on the year.

Stellar is currently alone at the bottom, down -6% so far in 2019. The second worst performer is Ripple, up +14%.

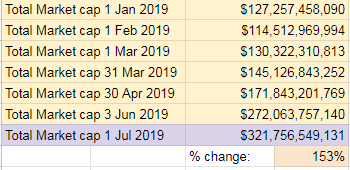

Total Market Cap for the entire cryptocurrency sector:

The total crypto market cap increased about $50B in June, a significant gain, but only half of what it added in May. The end of June saw the highest total market cap so far for 2019 and is now up +153% since the beginning of 2019.

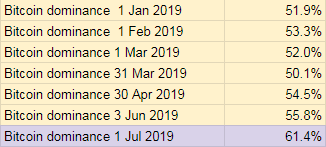

Bitcoin dominance:

Bitcoin dominance leaped in June, now at over 61%. This is the highest point Bitcoin dominance has reached so far in the 2019 and 2018 Top Ten Experiments.

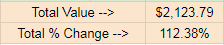

Overall return on investment from January 1st, 2019:

From May to June, my 2019 Top Ten portfolio’s value remained virtually the same, only losing about $15. If I cashed out today, my $1,000 initial investment would return $2124, a +112% gain. The return I would have received from the stock market (as measured by the S&P 500, see below) is about +17%.

Implications/Observations:

Although the overall market gained a solid $50B in June, the 2019 Top Ten as a group lagged behind, dropping about -2% collectively. In May, the gains from the Top Ten and the entire market were both exactly the same amount: +114%. This month, a 40% wide gap has emerged. For June at least, focusing only on the Top Ten was a losing strategy. This is reminiscent of the other group of cryptos as at no point in the Top Ten 2018 Experiment did the Top Ten strategy outperform the overall market.

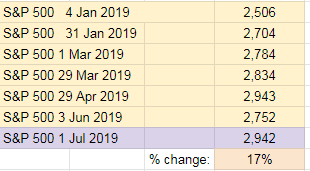

I’m also tracking the S&P 500 as part of my experiment to have a comparison point with other popular investments options. The S&P 500 is now up +17% since the beginning of 2019. Solid gains, but of course nothing like what we’ve seen in crypto so far this year. The initial $1k investment I put into crypto would have yielded only +$170 had it been redirected to the S&P compared to the $1,123 I’m currently up with the 2019 Top Ten Cryptos.

Conclusion:

Although the overall crypto market saw impressive gains, June ended up basically flat for the 2019 Top Ten. May proved to be too hard of an act to follow. While Bitcoin easily passed the $10k mark, it ended the month struggling to hold on to five digits. Are we back in consolidation mode or can BTC regain some momentum? Either way, how will the alts react?

If you’re just finding this experiment now, here’s the backstory: On the 1st of January, 2018, I bought $100 each of the Top Ten cryptos at the time for a total investment of $1000 to see how they would perform over the year. I tracked the experiment and reported each month. The result? I ended 2018 down -85%, my $1000 worth only $150.

After last year’s experiment ended, I decided to do two things:

- Extend the Top Ten 2018 Crypto project one more year. The experiment is now in its 18th month. You can check out the latest update here.

- What you’re reading now is the 6th report of a parallel project: this year I repeated the experiment, purchasing another $1000 ($100 each) of the new Top Ten cryptos as of January 1st, 2019.

Thanks for reading and the support for the experiment. I hope you’ve found it helpful. I continue to be committed to seeing this process through and reporting along the way. Feel free to reach out with any questions and stay tuned for progress reports.

This article contains affiliate links. If you click on a link in this article, I may earn a small commission at no extra cost to you.

Help keep the lights on at the Top Ten Crypto Index Fund Experiments.

Donate directly:

Bitcoin: bc1qqy4tlwydyrm3sjpyyq88es0cu9j9mdvqer3gwv

Ethereum: 0xC04Bc1996320f27c0A6018cB370c9469a9Dd3a4C

ADA: addr1qywnu55t8hpk4c3jf63tj5xywzej0uhwh7yput4u2z3fq7qa8efgk0wrdt3ryn4zh9gvgu9nylewa0ugrchtc59zjpuqlj6stg

XLM: GA5GJ2JDWC3GB3YXEVRBSR7UBLIB2ROIWZ5FEHML5WXGY5N3PAIDEOEA