This article contains affiliate links. If you click on a link in this article, I may earn a small commission at no extra cost to you.

Ways to pick up free Bitcoin:

Method #1: Open an Uphold wallet using this link. Buy or sell $250 in crypto in the first 30 days, get $20 in free BTC.

Method #2: Sign up for Nexo using this link. Top up your account with $500 in crypto and complete a few tasks. Make sure your assets are still worth $500 in 30 days and you will receive $35 in free BTC.

Method #3: Open a Coinbase account using this link. Buy $20 in crypto, get $20 in free BTC.

Happy HODLING!

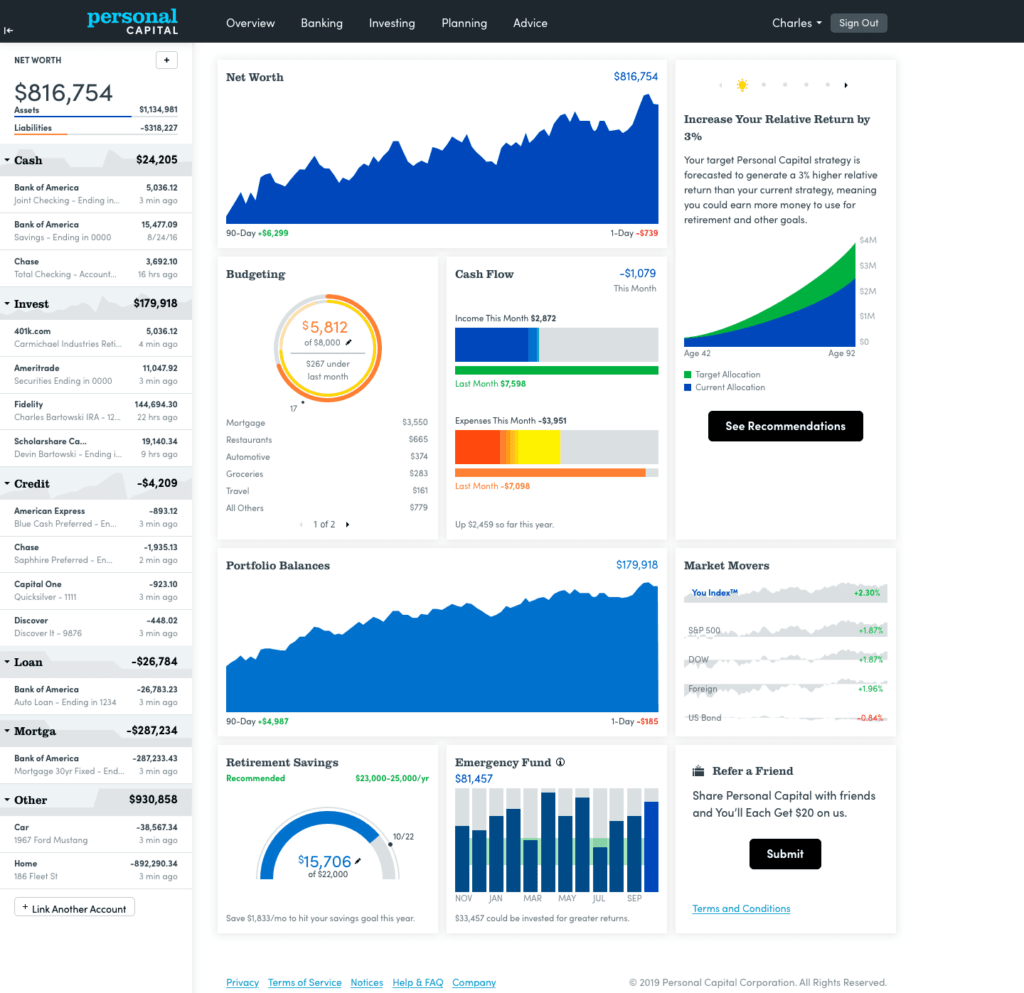

Don’t know how to figure out your net worth? Try Personal Capital, it’s free!

Sign up using this link, connect an investment account that is valued at $1,000, and get a $20 Amazon Gift Card free!

A bad day in the cryptoverse: invest in cryptocurrency, are you nuts?!??!

A good day in the cryptoverse: ALL IN!

With all the excitement around cryptocurrency, it’s common to feel fear of missing out and want to jump in head first when skies are blue. But as anyone who’s been paying attention over the last few years, Bitcoin and other cryptocurrencies aren’t a commitment that should be rushed or embarked upon lightly.

So, what should you be doing BEFORE investing in cryptocurrency? Here are five practical financial steps to take BEFORE investing in cryptocurrency:

Step One: Step On Your Financial Scale Regularly

Are you in a strong enough financial position to enter a highly volatile market without risking everything you’ve worked for or having heart failure along the way?

You might think so, but how do you know?

This may be the most difficult step of all. Just being open to the reality of your situation freaks many people out to the point of ignorance-is-blissism. But just like stepping on an actual scale can be painful sometimes (especially after polishing off that box of jelly doughnuts, alone, in the dark, late at night) it’s essential to be in touch with reality.

What does this look like practically?

Simple: add up all of your assets then subtract your debts. This equals your net worth.

This is an important number, write it down. I’d suggest recording your net worth monthly. It might be painful at first, but stick with it, watching that number slowly increase can be a huge motivation.

You can do this on your own with a spreadsheet or there are tools that can help you. I use Personal Capital. It’s free.

Once you input your financial information, Personal Capital will do the math for you. It keeps track of your cash, credit cards, loans, investments, car, and property. It will total your assets then subtract your debts and voilà! You got your Net Worth. It’ll look like this on your dashboard:

PC has one big drawback: it’s only able to connect to American financial institutions.

For some alternatives to Personal Capital, here are other options:

- Mint – Also free (they make their money through advertisements). Only connects to American and Canadian financial institutions.

- You Need a Budget – I’ve heard good thing about it, but after the free trial it cost $7/month and I’m too cheap for that. But people swear by it.

- EveryDollar – Free

- PocketSmith – For my non-American friends, I’d suggest checking out PocketSmith which claims to be able to connect to banks in 36 countries.

Step Two: Get Organized

After you’re aware of where you stand financially, you’ll want to get a handle on your bills and make sure to pay them on time. According to a recent survey of 1000 people by creditcards.com a whopping 42% admitted to being late on at least one credit card payment.

Any guesses on the #1 reason people paid their bills late, according to the survey?

60 percent of cardholders who paid late said it happened because they just plum forgot

We forget. We’re busy people with lots on our minds.

So, how do we not forget? Here are three practical suggestions:

Set Reminders – This is a relatively easy fix: set a Google calendar alert or an alarm on your phone. Pick a memorable day of the month to pay your bills. Have a responsible friend give you a reminder text or call.

Align Bills – Another organization hack – align the timing of your bills around your paychecks if possible. Most credit card companies allow customers to change the due date of the payment quite easily online. If you are paid at the end of month consider making all bills due sometime in the first week of the following month before you’ve had a chance to spend everything.

Bookmark! – One last practical suggestion is to create a “Bills” folder of bookmarks in your web browser.

When it comes time to pay bills, you don’t have to remember each individual bill/website, just click “open all tabs” and you’re all set.

Step Three: Open a High Yield Savings Account

According to the the latest FDIC data the average rate for a savings account in the US is 0.07% – which is ridiculous and borderline criminal.

Why not get a rate that’s 20x the national average? A good first stop for a list of the banks with the highest rates is Doctor of Credit.

Personally, I have used Barclays online savings for years. I am currently receiving 1%, which is not much, but better than 0.07%. If you’re going to park your money somewhere, might as well get the best interest you can on it.

Step Four: Do What You Can to Feel More Pain

What if you’re aware of your situation, you’re paying your bills on time, and you have a high interest savings account – but still find yourself over-spending or not on track to meet your financial goals?

You’re going to have to trick your brain by introducing a little more pain.

Okay, how?

Consider using cash more – Do you know you’re more likely to spend more if you pay by credit card than if you pay by cash? This is because we tend to feel more pain when we let go of the physical cash than we do when we pay by plastic. Some hard-liners pay 100% in cash and swear by the method. They argue that the perks and convenience of credit cards pale in comparison to how much they’re saving just by spending less.

And why do they spend less? Because they feel the pain more than those who pay with credit cards.

There’s also evidence to suggest that using cash increases the feeling of satisfaction with the purchase compared to the satisfaction received when paying with credit.

I am not one of these people – I use credit cards, but make sure to pay off 100% of the balance on time every month. But not a bad strategy to employ for a while if you’re struggling to manage your money in a healthy way.

Turn off auto-payments – While I can’t make 100% cash work personally, I have found that turning off auto-payments has had a similar affect. I have never used auto-payments. It goes back to the pain principle. I want to feel the money leaving my pocket or bank account. If not every transaction at least regularly, when I pay my bills.

Budget to the last penny – Talk about pain! But again, you’ll find some very well off people that swear by this method for similar reasons. Accounting for every single last cent will give you a very real sense of value and the consequences those designer jeans may have on your bottom line.

Step Five: Diversify

Remember when mom told you not to put all your eggs in one basket?

Yeah, listen to mom.

Going all in on any asset class, whether cash, stocks, bonds, gold, real estate, or crypto is a recipe for disaster, or at least ulcers. Spread out your investments, don’t pick stocks: I recommend broad based, low cost index funds.

Once you’ve taken these steps, you’ll have better control over your money and a better idea of where you stand financially.

If you haven’t taken these very basic actions, I’d suggest you step back from crypto…way back…while you get your financial house in order.